The food crisis creates short-term challenges but also points to systemic issues in the food sector.

Georg Zachmann Pauline Weil and Stephan von Cramon-Taubadel

Executive Summary

The Russian war against Ukraine has put at risk a significant share of global food exports, and has contributed significantly to strongly rising global food prices. This has made poor, food-import dependent countries more vulnerable, with potentially serious humanitarian consequences. The crisis also has negative security, migration and foreign policy repercussions for the European Union.

The EU and its members have a number of policy levers to address the crisis. These include agricultural, trade, environment, aid, energy, fiscal and foreign policy. However, in the complex interplay of local and global, agricultural and non-agricultural markets, apparently simple solutions can have significant unintended consequences and policy trade-offs must be taken into account.

While EU agricultural policy can address the crisis directly by adjusting production, energy policies also have an impact on food security through the complex relationship between the food and energy systems. Energy is an input to food production but also, as bioenergy, competes for agricultural commodities. Fiscal policy can discourage inefficient food consumption and food waste, while trade policy and aid can improve the allocation of agricultural production factors (eg fertilisers) and products. Increasing information sharing on food stocks and building trust are prerequisites for trade policy and diplomacy to limit export restrictions, thus alleviating some of the price pressures on international markets.

The crisis highlights food-system fragilities when confronted with global conflicts, climate change and economic shocks. Policies should seek to increase shock-resilience, for example by reducing structural rigidities in production, trade and consumption patterns, and by encouraging sustainable production in import-dependent countries. This is especially important considering that most food production is locally consumed. Only 20 percent of the global cereals volume is traded, making the current shock significant in terms of globally traded volumes (Ukraine represents 10 percent of the global grain market), but not relative to overall volume (Ukraine represents 2 percent of global grain production).

Excellent research Assistance by Conall Heusaff and Ryan Strong is gratefully acknowledged. The authors would also like to thank internal and external colleagues who provided very helpful insights and feedback. This paper was produced with the financial support of the European Climate Foundation.

1 Introduction

Food prices reached historic highs in 2022, leaving a growing number of people worldwide at risk of food insecurity. This could prove to be persistent: because of the ongoing war in Ukraine and climate events, the food situation might not normalise quickly. For the European Union, the direct impact of the shocks to the global food system is mainly seen in higher food product prices. In poorer countries, by contrast, the shocks translate into food insecurity and humanitarian crises. Over 10 percent of the global population is facing hunger in 2022, with the number of people facing acute hunger jumping 2.6 times since 2019, to 345 million (WFP, 2022a). These developments are taking place in an environment of geopolitical tensions, and might therefore threaten the security, migration and foreign policy position of the EU.

In this paper, we assess the EU’s options. The analysis is organised into two main sections. A background section provides a quantitative assessment of the shortfall of supply of food in 2022 and 2023, before showing the response in terms of agricultural prices and trade. We then show the relative exposure of the most-affected countries to the shortfall..

The second part of the paper then assess the potential gains and costs for each policy option the EU has at its disposal. These summarised trade-offs support a policy-mix choice.

The food crisis creates short-term challenges but also points to systemic issues in the food sector. While short-term fixes can moderate the adverse impact of the crisis, a long-term and systemic approach is needed to increase the resilience of the sector. We discuss short- and long-term policy options jointly and summarise our findings in the conclusion and a summary table.

2 Short-term challenges to global food security

2.1 Effects of Russia’s invasion on grain production in Ukraine

The ultimate military outcome of Russia’s attack on Ukraine remains unclear, but the conflict is having major effects on international markets for grain and, by extension, on global food security (FAO, 2006). This paper mostly focuses on the volume and price of available food at the macro level, as proxies to evaluate food security, even if other relevant aspects to food security are left out.

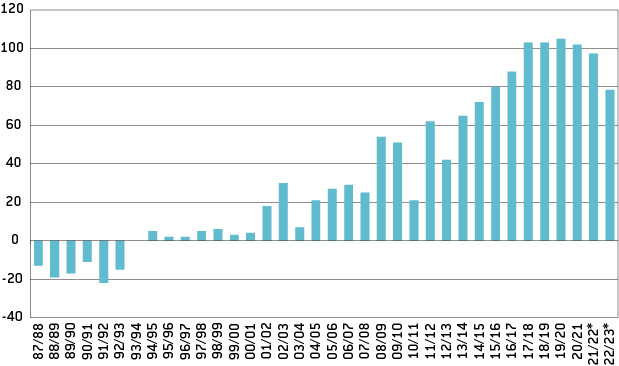

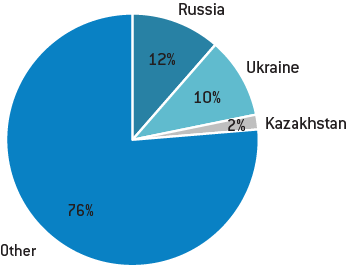

Two decades ago, the agricultural implications of a military conflict between Russia and Ukraine would have been severe for those countries, but of little global consequence. According to United States Department of Agriculture (UDA) World Agricultural Supply and Demand Estimates (WASDE) reports between 1992 and 2002, Ukraine, Kazakhstan and Russia together accounted for average annual net exports of 3 million tons of grain, representing on average 2.3 percent of global cereal exports. From 2017-18 to 2020-21, however, the grain exports of these three countries exceeded 100 million tons (Figure 1). In the 2020-21 marketing year, the combined Ukraine/Kazakhstan/Russia share of global grain exports was just under 25 percent (Figure 2).

Figure 1: Volume of combined cereal exports from Russia, Ukraine and Kazakhstan (million tonnes)

Source: Bruegel based on USDA WASDE.

Figure 2: Breakdown of global cereal exports by volume in 2020-21

Source: Bruegel based on USDA WASDE.

Russia’s military aggression is affecting Ukrainian agricultural production and export capacity in different ways. All of Ukraine’s ports were blocked for almost six months from February to July 2022. A Ukraine-Russia ‘grain corridor’ agreement brokered by Turkey and the United Nations in late July made it possible to export grain from the ports of Odessa, Chornomorsk and Pivdennyi Seaport (sometimes referred to as the ‘Odessa port range’)[1]. However, clearing requirements[2] and insurance premiums still weigh heavily on the volumes and margins at which grain can be exported. Furthermore, Ukraine’s other major ports, including Mykolayiv, Mariupol and Kherson remain closed at time of writing. Some have seen heavy fighting, and their grain terminals, rail connections and harbour facilities have been damaged.

Experts from the Center for Food and Land Use Research at Kyiv School of Economics initially estimated that 2 million tons per month could be shipped via the grain corridor from the Odessa port range, but much more has been realised[3]. From August until the middle of November, over 11 million tons, or over 3 million tons per month, was shipped (UN, 2022). On 28 October 2022, Russia suspended the grain corridor, only to reopen it on 2 November, and on 17 November, an agreement to extend the grain corridor for another 120 days was announced[4].

Some grain is leaving Ukraine by the land route through the EU (eg via Poland and Germany to ports such as Gdynia and Rostock, and via the Romanian port of Constanța). However, land transport can only handle perhaps 10-15 percent of the volume that would usually be exported via Black Sea ports. Furthermore, despite pledges to streamline border formalities and facilitate the land route, truck queues at the border have reached as long as 30 kilometres, leading to waiting times of four to five days and more, which can erode margins by as much as €100 per tonne (for comparison, prices were between $150/tonne and $350/tonne during most of 2018-2022). As a result of these bottlenecks, large amounts of the 2021 and 2022 harvest are backed up in Ukraine. USDA predicts that Ukraine will export 39.5 million tons of grain and oilseeds in 2022-23, but Ukraine’s total grain and oilseed export potential lies somewhere between 55 and 60 million tons (Cramon-Taubadel, 2022).

The war has also affected Ukraine’s ability to produce a new crop in 2022. Regions hit by the conflict account for a significant part of Ukraine’s pre-war production. Kherson and Zaporizhzhia in south-east Ukraine and Odessa in the south together accounted for 25 percent of barley production, 16 percent of sunflower seed, 20 percent of rapeseed, 20 percent of wheat, according to USDA (2022a). In February 2022, prior to Russia’s attack, USDA predicted that Ukraine would harvest roughly 87 million tons of grain in 2022, but estimates from November are for just below 60 million tons, a reduction of 27 million tons. The war has made it difficult for farmers to apply fertiliser and other applications. In zones of heavy fighting, farmers were unable to access their fields at all. Elsewhere, retreating Russian troops left behind mined fields and stole equipment such as tractors and combine harvesters. The war has also severely affected the planting of summer crops such as corn and sunflower, which usually takes place from March to May. Furthermore, 2021 harvest backlogs in Ukraine are hindering farmers in storing the 2022 harvest properly. Substandard storage leads to quantity and quality losses.

These factors will affect the next crop in 2023. Farmers who sell less grain than expected from the 2021 and 2022 harvests will be less able to purchase inputs, including seed, fertiliser and fuel, which are required to plant next year’s winter crops. Ukrainian farmers are also receiving very low prices for what they can sell, as bloated costs of shipping grain by sea and land inflate marketing margins and reduce their farm-gate prices. Seeded acreage for winter grain in Ukraine might fall by at least 30 percent in the 2022-23 crop year[5].

What volume of Ukrainian exports is missing from world markets as a result? Based on projections in the USDA November WASDE report, we can begin to piece together more accurately how Russia’s aggression will affect Ukrainian grain exports.

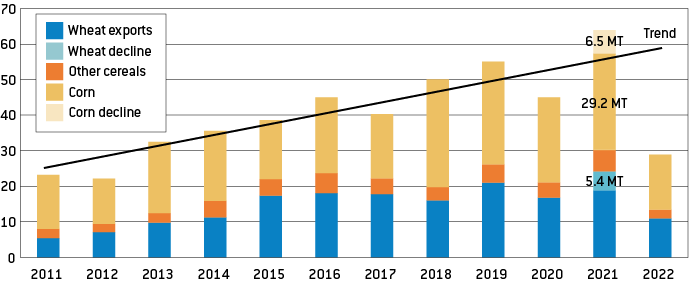

Figure 3 shows how Ukrainian exports of cereals grew over the decade up to 2020-21. For 2021-22, Figure 3 it shows the volume of Ukrainian exports as projected in the January 2022 WASDE report, before Russia’s invasion (63.9 million tons). By the November 2022 WASDE report, these exports for 2021-22 had been revised downward by a total of 11.9 million tons (5.4 million tons of wheat and 6.5 million tons of other grains). This reduction is entirely due to Russia’s aggression. The grain in question was harvested in 2021, but has been destroyed or stolen, or cannot be exported because Russia has blocked and demolished Ukraine’s ports.

Based on the last 10 years of Ukraine’s exports, we have calculated a trend and projected it to 2022-23, the marketing year that began in July. According to this trend, Ukrainian exports of 58.1 million tonnes could have been expected under normal conditions in 2022-23. In the November 2022 WASDE report, however, the USDA projects total Ukrainian grain exports of only 28.9 million tons, 29.2 million tons below the trend-based projection (Figure 3). As weather conditions were good in the region (Russia has produced a record wheat harvest of 100 million tons this year, compared to 75 million tons in 2021-22), this shortfall of 29.2 million tons very likely underestimates the difference between what Ukraine will actually export, and what would have been possible without Russia’s military aggression.

Figure 3: Anticipated shortfall in grain exports from Ukraine

Source: Bruegel based on USDA WASDE.

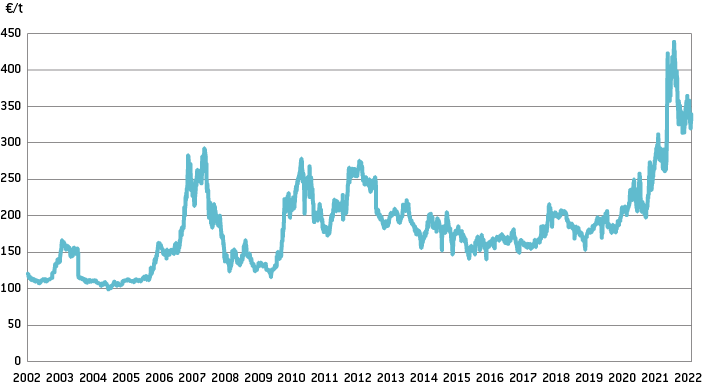

Taking 2021-22 and 2022-23 together, therefore, it appears that global grain markets currently face a shortfall of at least 41 million tons in Ukrainian exports. In isolation, the missing 12 million tons in 2021-22 would not cause a major upheaval. But the spectre of a further shortfall of almost 30 million tons in 2022-23 (representing 7 percent of the 434 million tons of projected global grain trade this year[6]), combined with the growing certainty that Ukraine’s production and export potential will be substantially reduced for at least another two to three years, initially pushed the international market price for wheat from around €250/tonne shortly before the war to more than €400/tonne in May 2022, before falling back to about €330/tonne at the time of writing.

How will the Russian aggression affect agricultural production elsewhere in the world? In Russia itself, exports of the 2021-22 harvest have continued, although delayed and hampered by financial sanctions, some logistical problems (eg the difficulty of securing and insuring shipping capacity that is willing to operate in the Black Sea under current conditions) and Russia’s own grain export taxes. As noted above, Russia will harvest a record wheat crop in 2022. In the medium term, it is likely that Russian production will not trend upwards as strongly as it has in the last decade as sanctions affect imports of modern agricultural machinery and spare parts, while military mobilisation and emigration could reduce the agricultural and related-services workforce. The 2022 grain harvest in the other major exporting countries of North and South America was generally good, with no major negative surprises. USDA is currently forecasting a global grain crop of roughly 2,242 million tons in 2022, roughly 40 million tons or 1.7 percent less than the previous year.

2.2 Effects on prices

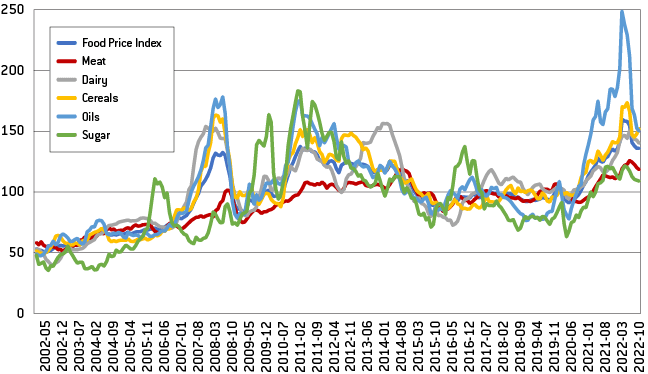

Figure 4: FAO price indexes (2014-16=100)

Source: FAOSTAT.

Figure 5: Wheat futures prices have declined from historical highs in May

Source: Bloomberg.

Prices have come down somewhat from their extreme highs immediately following Russia’s attack on Ukraine (Figure 4). However, because of the strength of the dollar, prices have not fallen by as much in some other currencies, such as the euro. The fact that the 2022 harvest has been generally good in most of major exporting regions has been a significant source of relief. The success of the Black Sea grain corridor has also provided some relief. In addition, high grain prices have triggered some demand-side response. For example, feed use is down in the EU as animal numbers have fallen in recent months.

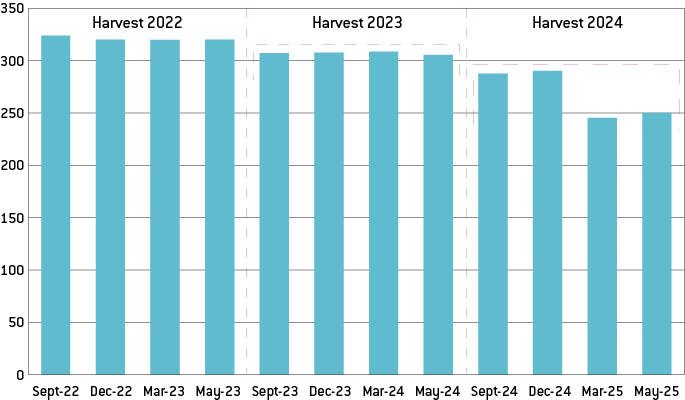

Overall, the situation on world grain markets remains critical, but it has not deteriorated as much as seemed possible in the months immediately after Russia’s attack on Ukraine. Nevertheless, prices remain high, and markets anticipate that, for example, wheat prices will remain above €250/tonne for at least the next two years, after averaging €175/tonne in the twenty years to 2022 (Figures 5 and 6). The World Bank also expects prices to start decreasing from 2023 (World Bank, 2022a), but to remain much higher through 2024 than they were in 2020-21. Price pressures could linger further if input prices continue to rise, according to the World Bank. And overshadowing everything is uncertainty about the ongoing military conflict. A Russian exit from the deal to guarantee the Black Sea grain corridor, the deliberate sinking of a grain ship from Odessa, or any sort of nuclear mishap in Zaporizhzhia would send prices soaring once more.

Figure 6: Market futures for wheat on 20 November 2022

Source: Bloomberg.

The war in Ukraine has also had major impacts on farmers’ input prices globally. The UN Food and Agriculture Organisation’s net Global Input Price Index (GIPI) is a weighted indicator of the prices of energy and fertilisers prices. In the past year, the average monthly growth rate of the net GIPI has far outstripped the growth rate in food prices – 6 percent (net GIPI) compared to 2 percent of the FAO Food Price Index (Schmidhuber and Qiao, 2022).

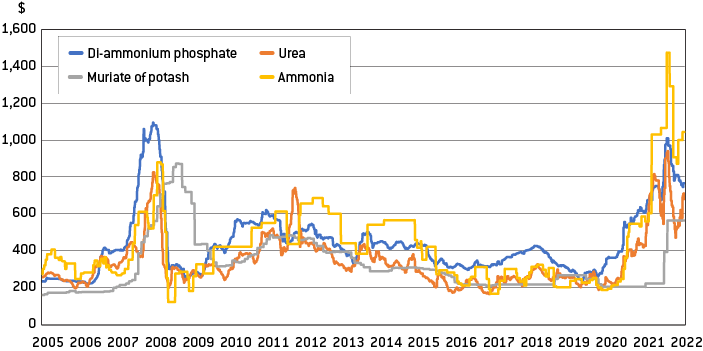

Figure 7: Fertilizer prices have dropped from their historical peak in April 2022

Source: Bloomberg.

Fertiliser prices are at historical highs, especially for ammonia-based fertilisers that are largely produced using natural gas (Figure 7). This hike has been compounded by higher energy prices, which affect the costs of operating farm machinery, drying grain and cooling milk and other perishable products.

For farmers, this translates into lower net output prices. A loss of income is problematic especially for smallholders, that produce a third of global food supply. Higher fertiliser prices will limit fertiliser use, which reduce yields. Ultimately, higher input prices reduce the incentives that farmers have to produce more cereals when cereal prices are high. This will dampen the supply response that would usually result from high output prices, and thus feed anticipation of lasting high prices.

2.3 Effects on trade

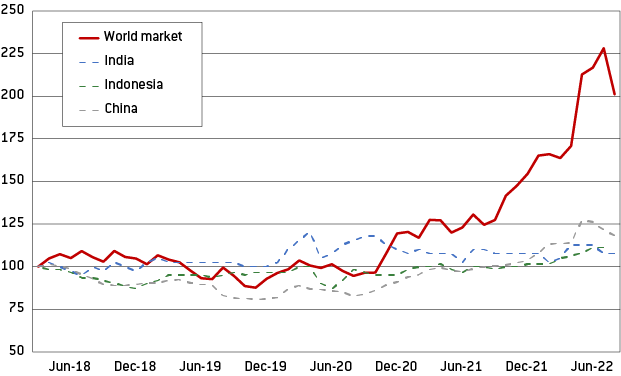

The price and supply shock in global food trade has been aggravated by countries reacting to shield their populations. Reactions range from guaranteed price ceilings for consumers, to export restrictions. Figure 8 shows that prices for wheat and flour in China, India and Indonesia have been largely decoupled from global wheat price developments. Together these three countries have a population of over 3.1 billion. Whatever specific policies these countries apply, their effect is the same: they shield the country’s population but have a detrimental impact on all others by aggravating the shortfall in traded agricultural products and creating upward price pressures (Kleimann, 2022). Poor and import-reliant countries are the most exposed to such policies.

Figure 8: Wheat and wheat flour prices on the world market and in China, India and Indonesia (January 2018 = 100)

Source: Bruegel based on FAO Food Price Monitoring and Analysis Tool.

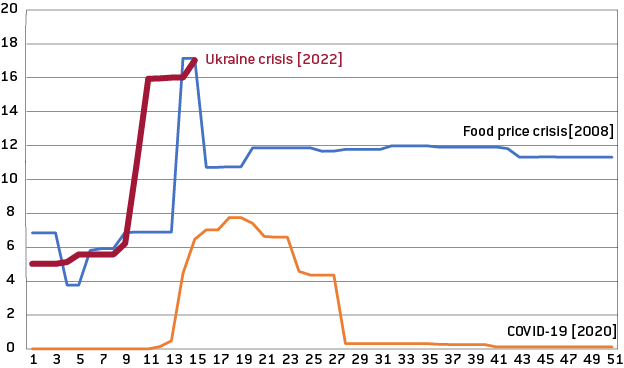

The International Food Policy Research Institute (IFPRI) estimated that by mid-April 2022, 17 percent of traded calories were impacted by export restrictions, similar to the food crisis of 2008 (Figure 9) (Glauber et al, 2022). In the 2008 food crisis, export restrictions were lifted after governments were assured that the supply shock would be short-lived. But this time around, reassuring evidence cannot be provided, as shown by market anticipation of durably higher prices. Coordination and trust-building through multilateralism is the main avenue to mute national beggar-thy-neighbour policies.

Figure 9: Share of globally-traded calories impacted by export restrictions, by week of selected crisis

Source: IFPRI.

Export restrictions affect not only food trade, but also food production, as governments have also taken steps to limit fertiliser exports. This tendency, mostly felt as an impact of China’s export restrictions set up in 2021 (Gro Intelligence, 2022a), predates the outbreak of the war in Ukraine. The IFPRI assessed that by January 2022, 20 percent of globally traded fertilisers were affected by export restrictions (Laborde, 2022a), contributing to further prices pressures and unequal access (Hebebrand and Laborde, 2022).

2.4 Most-exposed countries

The shortfall from the reduced supply from Ukraine will imply some trade reorientation. However, there are high risks that this might not occur as smoothly as it should in order to reach the neediest populations in time. The challenges are first logistical. Sourcing from routes other than the Black Sea is longer and more expensive, especially given higher energy prices. This is a problem in particular for countries for which Black Sea exporters are the closest suppliers. This affects countries in the Middle East and North Africa, Central Asia and sub-Saharan Africa.

Table 1 shows the countries most exposed to food trade disruptions from Russia and Ukraine. They are ordered according to their cereal import dependency ratios – the ratio of net cereal imports over national consumption, giving a measure of reliance on external food supplies. Even if these countries have similar cereal import dependency ratios, their exposure to food insecurity is relative to the share of cereal used to directly feed the population, as opposed to cereals for other uses (eg feed, bioethanol and sometimes re-export). Low-income countries (eg Lebanon, Yemen) face food insecurity risks, while high-income countries (eg Israel, Netherlands) do not.

Table 1: Countries most reliant pre-war on food imports from Russia and Ukraine

| Country | Cereal import dependency ratio | Share of Russia and Ukraine in total cereal imports | Dependency on cereal imports from RU and UA | ||

| Georgia | 63 | 85 | 53 | ||

| Armenia | 53 | 92 | 49 | ||

| Lebanon | 99 | 47 | 46 | ||

| Israel | 97 | 37 | 36 | ||

| Tunisia | 66 | 47 | 31 | ||

| Yemen | 96 | 31 | 30 | ||

| Egypt | 48 | 59 | 28 | ||

| Azerbaijan | 31 | 77 | 24 | ||

| Mongolia | 37 | 61 | 22 | ||

| Sudan | 24 | 89 | 21 | ||

| Netherlands | 85 | 21 | 18 | ||

| Portugal | 74 | 17 | 13 | ||

| Morocco | 57 | 20 | 11 | ||

| Spain | 37 | 23 | 8 | ||

| Indonesia | 10 | 24 | 2 | ||

| Belarus | 3 | 73 | 2 | ||

| Tanzania | 4 | 51 | 2 | ||

| Uganda | 5 | 34 | 2 | ||

| China | 4 | 19 | 1 | ||

| Turkey | 1 | 68 | 1 |

Source: FAOSTAT.

The capacity of countries to face the shock also depend on their income levels. Because poorer countries tend to have lower food stocks, their populations are more exposed to trade disruptions. Net food-importing poorer countries also have less capacity to service higher import bills. Table 2 shows the countries for which the value of cereal imports is greatest relative to the value of their exports. For these countries, increases in cereals prices create strong pressure on their external accounts. The most-exposed need aid to be able to buy cereals on international markets. Of the countries in worrying situations, those that need to diversify away from Ukraine and Russia are mostly located in the Middle East and North Africa, while those that are most exposed to acute trade imbalances are in sub-Saharan Africa.

Table 2: Countries for which cereal imports represent over 10 percent of their total exports in value

| Share of cereal imports over total exports in 2019-2021 | ||

| Yemen | 3584% | |

| Gambia | 169% | |

| Kiribati | 80% | |

| Comoros | 76% | |

| Benin | 61% | |

| Cabo Verde | 60% | |

| Sao Tome and Principe | 48% | |

| Nepal | 47% | |

| Saint Vincent & the Grenadines | 37% | |

| Niger | 34% | |

| Ethiopia | 31% | |

| Tajikistan | 31% | |

| Burundi | 27% | |

| Afghanistan | 23% | |

| Grenada | 20% | |

| Cayman Islands | 18% | |

| Senegal | 16% | |

| Maldives | 15% | |

| Egypt | 15% | |

| Kenya | 14% | |

| Mozambique | 12% | |

| State of Palestine | 12% | |

| Rwanda | 12% | |

| Samoa | 11% | |

| French Polynesia | 11% | |

| Jamaica | 11% | |

Source: COMTRADE.

Import dependency and limited capacity to absorb the food-price shock is compounded by exposure to the shock in the fertiliser sector. Countries set to endure a supply shock are thus also set to endure a production shock. Out of the 40 African countries with available data, 29 rely fully on imports for their domestic fertiliser needs. For the Americas, 16 out of 27 countries rely on imports for at least 90 percent of their domestic fertiliser use.

Hence, reduced food exports and rising agricultural input prices (fuel, fertiliser) are substantially increasing food insecurity in a number of vulnerable countries in Europe’s vicinity. If this risk materialises, the humanitarian consequences could be drastic, possibly translating into political instability or even conflicts. This would set back future development prospects in the affected countries, and might also increase migration pressure.

3 Possible European responses

Europe possesses a number of levers that could reduce food insecurity in its vicinity and beyond. The EU can devise policies to (1) increase agricultural production, (2) shift agricultural production towards food, (3) reduce domestic consumption, and (4) improve global food allocation. There are virtually no simple no-regret options; instead most policy levers imply trade-offs with other policy goals, while some options that look like attractive short-cuts would in fact be ineffective or counterproductive.

3.1 Increase production

To make up for the lost globally-traded volumes, EU agricultural policy could seek to boost (or prevent sliding of) agricultural production in the EU.

3.1.1 Relax constraints on fallow land management

The EU encourages non-use of some potentially productive agricultural areas (fallow land), to protect biodiversity, among other reasons. Given the food crisis, in March 2022, the European Commission gave EU countries permission to derogate from the current fallow rules and to provide greening payments[7] even if farmers do not set aside land but use it to grow food and feed in 2022 (European Commission, 2022a). The derogation has been partially extended into 2023[8].

Under the latest reform of the EU’s Common Agricultural Policy (CAP), all farms will have to set aside at least 4 percent of their agricultural land from 2023 to be eligible for direct payments.

According to the FAO there were around 6.1 million hectares of fallow land in the EU in 2019 (excluding the United Kingdom). This represents about 6 percent of the arable farmland in the EU. Fallow is not equally distributed among EU countries, nor is it necessarily proportional to their sizes. Spain alone has half of the fallow land, while Germany reported less fallow land than Greece (Luckmann et al, 2022). Generally speaking, when farmers set aside land for fallow, they choose areas with below-average productivity[9]. In addition, the biodiversity gains from keeping land fallow will help to sustain the productive capacities of EU agricultural areas in the medium to long term.

The management of cropland and fallow land can provide potent levers to reduce some of the footprints of the sector, in terms of greenhouse gas emissions, biodiversity and water use (Beyer et al, 2022). Moreover, farmers would want to use more pesticides and fertilisers on the less-productive fallow land, which would be even more detrimental to the EU reaching its biodiversity objectives (Strange et al, 2022).

Ultimately, turning the current 6 percent of land that is fallow back to production is unlikely to be realistic. Much fallow land is often very unproductive land that would not do much to boost EU production; the market relief benefit would be small relative to environmental damage costs. Delaying the green direct payments requirement to devote 4 percent of land (including fallow land) to non-productive uses, on all farms of at least 10 hectares – originally scheduled to begin in 2023[10] – has been partly relaxed until 2024[11]. This might allow somewhat higher European production in 2023 as this land has been farmed to date, so delaying the measure would not lead to fallow land being brought back into production, with the attendant environmental damage. Since the 4 percent allocation will be required everywhere in the EU, including in the most productive regions, taking this land out of production would cause measurable output reductions at a time when world markets are very tight. The benefits in terms of increased food production from what might otherwise be left fallow (less than 1 percent of EU production according to Boell, 2022) need to be corrected for the reaction of the global food system to those volumes, and traded-off against the foregone environmental benefits and the policy credibility cost of ad-hoc policy changes.

3.1.2 Support fertiliser usage

Innovation and technology have allowed European farmers to substantially increase yields and become among the most productive in the world (OECD, 2001). EU value added per agricultural worker is $26,000, or seven times higher than the global average (euro area is 11 times higher) (Ritchie, 2022). EU cereal yield, or return per unit of land used, stands at 5.5 tonnes per hectare compared to 1.3 t/ha world average. The extensive use of machinery and inputs such as fertiliser and pesticides led to an intensification of production. European regulators now want to enhance the sustainability of production (OECD, 2021).

The current context of historically high gas prices in Europe puts pressure on the profit margins of fertiliser producers. The resulting higher fertiliser prices are a challenge for farmers. Pre-crisis levels of fertiliser use in Europe does not have to be sustained at all costs, to limit the industry’s environmental footprint, for the sustainability of agriculture production and to ensure access to fertilisers in poorer countries. Policymakers are faced with a balancing act as higher market prices have led input prices to jump 21 percent for the agriculture sector on average (Ducros, 2022). Volatile input and output prices make it harder for farmers to anticipate future revenues and plan harvests.

In 2018, Europe used around 11 million tons of fertiliser, most of which was nitrogen-based (Eurostat, 2022a). Average fertiliser use (per hectare) in the EU is the sixth highest in the world, at 141 kilogrammes per hectare. The nitrogen efficiency rate (ratio of nitrogen being fixed by plants to nitrogen input from fertilisers) is high in Europe, with efficiency rates of 50-70 percent[12]. Poor regions, such as sub-Saharan Africa, use much less fertiliser, ranging from 0.2kg/ha in the Central African Republic to 90kg/ha in Botswana (Ritchie, 2021a). Improving allocation is a priority. The World Food Programme expects that, in sub-Saharan Africa, increases in fertiliser and fuel prices could reduce cereal production by 7.2 million tonnes in 2022, an amount that could feed 6.4 million people (WFP, 2022b).

There are three main types of fertiliser: nitrogen, phosphorus and potash (potassium chloride). These fertilisers complement one another. Most nitrogen fertilisers are based on ammonia, which is produced using natural gas. Nitrogen is crucial for the creation of nucleic acids, chlorophyl and plant growth regulators. Phosphorous is essential for the creation of cell membranes, nucleic acids and helps with energy metabolism. Potassium is necessary for osmotic regulation and enzyme activation (Sinha, 2020) – ie the three different types of fertilisers are not strict substitutes, but rather complements.

Currently, fertiliser trade is significantly affected by historically high prices and disruptions from trade sanctions that pre-date the war and come from both sides, the pro-Ukrainian coalition on the one side and Russia and Belarus on the other[13]. Most nitrogen fertiliser in the EU comes from Russia[14], while potash is largely imported from Russia and Belarus (European Commission, 2020a). Alternative potash supplies might be possible from Canada in the longer term. But it will take time and investment for Canada to exploit its potash resources[15]. Phosphorous fertiliser, which is generally imported from Morocco, should be unaffected[16] by current upheavals.

Before the war, fertiliser production in the EU was a small part of global fertiliser production (9 percent of nitrogen, 3 percent of phosphate, 8 percent of potash)[17]. Since natural gas accounts for 80 percent of the cost of production of nitrogen fertiliser and natural gas prices have surged (to ten times higher than before the war in Europe and about three times higher in the US[18]), the production costs have also multiplied. Surging prices and disrupted supply are especially significant for Europe because of its past 40 percent reliance on Russia for natural gas imports. Russian gas import cuts have caused fertiliser production to be significantly cut in Europe. European production of ammonia has been halved, and that of nitrogen fertiliser by 67 percent (Gro Intelligence, 2022b).

In the war context, as it struggles to reduce its energy reliance on Russia and reduce energy consumption, the EU is turning to other producers to substitute Russian imports of fertiliser production inputs and fertiliser. But alternative suppliers have their own historic markets. Morocco, for example, has commitments and geopolitical interests in servicing sub-Saharan African farmers. In the medium term, it is reasonable to expect that other countries with natural gas supplies, for example in the Middle East, will boost their production of nitrogen fertiliser. It is not inconceivable that the delayed response to current incentives, as ammonia plants come on line in the coming years, will lead to an oversupply of nitrogen fertiliser in the medium term.

The current stress on fertiliser markets is expected to continue to affect food security and inflation for the next three to five years (Gro Intelligence, 2022b). A reduction in fertiliser use worldwide by 1 percent would lead to a shortfall of 0.4 percent in calories, while 5 percent less fertiliser could lead to a 2 percent shortfall. Some European countries could be exposed to close to 3 percent shortfalls if 5 percent less fertiliser is used. The impact would be much more strongly felt where the marginal productivity of fertiliser is highest, especially in African countries. The impact of sustained reduced fertiliser usage over several years could have long-lasting consequences for yields that are at present unforeseen.

The current crisis and the possibly persistent increase in fossil fuel prices might accelerate the shift towards reduction or substitution of chemical fertilisers. Mainly for environmental reasons, the EU Farm to Fork strategy targets at least a 20 percent reduction in inorganic fertiliser use in Europe by 2030 (European Commission, 2020b). Environmental studies have shown consistently that fertilisers can have significant environmental impacts, from eutrophication to leaching into ground water[19]. Additionally, the nitrogen fertiliser supply chain is found to account for 11 percent of greenhouse gas emissions from the agriculture sector, and 2.1 percent of overall global emissions (Menegat et al, 2022). The EU has worked to expand advance payments for farmers, some of which will certainly go towards spending on more fertilisers (European Commission, 2022a). Meanwhile, differentiated capacity in adapting to the reduced availability and higher prices of fertilisers across the world needs to be a core focus for policymakers.

To prevent agricultural production cuts, the EU could support domestic fertiliser use in response to the exceptionally high prices. All things being equal, this would entail even higher fertiliser prices in the rest of the world, forcing poorer countries to use less fertiliser. This might make sense when focusing on maximising global agricultural production because fertilisers use is likely more productive in the EU than in some poorer countries. But in a world with substantial barriers to trade/finance, additional food imports might not be enough to compensate for lower production (self-sufficiency) in vulnerable countries. Moreover, reduced production in vulnerable countries (resulting from reduced access to fertiliser) might echo in subsequent years as lower production in one year translates into less ability to prepare (buy seed and material) for future harvests.

Hence, ensuring equity in fertiliser access is a potent lever to alleviate food insecurity risks in the short term. In the longer term, ensuring equitable fertiliser use must be complemented by measures to ensure sustainable fertiliser use, to safeguard ecosystems and emissions reductions.

3.2 Shift production towards food

To make more food available on global markets, EU agricultural policy could discourage non-food agricultural production, in order to encourage farmers to produce more food.

3.2.1 Reduce incentives for energy crops

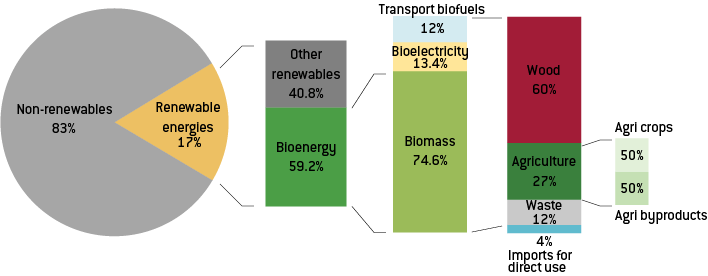

The EU’s growing demand for bioenergy is linked to its commitment to increase the overall share of renewable energy in the energy mix[20]. As such, the EU could reduce bioenergy demand and free up edible crops for food rather than fuel. However, this would have consequences for other key areas of European policy, for example by increasing the demand for fossil fuels during the ongoing energy crisis. Hence EU agricultural and energy policies interact strongly.

The main uses of bioenergy are heating (75 percent of total use), followed by electricity generation and transportation fuels. Biomass supply for bioenergy in the EU reached 140 million tonnes of oil equivalent (Mtoe; primary energy) in 2016 (EU, 2019), corresponding to more than 10 percent of EU primary energy supply. Most of the bioenergy (60 percent) is derived from wood (ETIP, 2020). Agriculture accounts for 27 percent of the biomass used for European bioenergy, with half of the agricultural amount coming directly from crops and the other half from agricultural by-products. Waste makes up the remaining 12 percent (ETIP, 2020).

Biofuels are the bioenergy sub-segment of most concern in relation to food security. Biofuels rely on agriculture products for 70 percent of their production, as opposed to 27 percent for overall bioenergy in the EU (Figure 9). Biofuels consist either of bioethanol (made by fermenting the sugar present in beets or grains), biodiesel (made from animal or vegetable oil), or biogas (mainly biomethane made from breaking down either organic or waste material in an oxygen-free environment). Currently the EU uses 10 million tons of cereals (wheat, corn and barley) for bioethanol and 6.3 million tons of vegetable oil (rapeseed and sunflower) for biodiesel (Transport and Environment, 2022).

Biofuel for transport has been promoted since the 2000s and was supported by the Renewable Energy Directive (RED, 2009/28/EC). Concerns over the impact of a surge in demand for biofuels on agriculture prices and land use led the EU to adopt RED II (Directive (EU) 2018/2001) in 2018. This limits the share of biofuels from edible sources for transport, favouring instead advanced biofuels, batteries and hydrogen. But the use of crops for bioenergy under current plans is still expected to increase. Food-based biofuels continue to dominate production, but environmentalists in particular doubt that increasing the targets for the share of renewable biofuels in the EU is the right approach (Transport and Environment, 2021). The EU also plans to increase biogas use to partly replace natural gas imports from Russia (European Commission, 2022b). Biomethane is sourced mostly from crops such as maize (42 percent) (Abdalla et al, 2022), especially in Germany (Wouters et al, 2020).

Europe is the largest producer (33 percent) and consumer of biodiesel, followed by the US (Enerdata, 2021). According to the NGO Transport and Environment, the EU imports around 14 percent of its bioethanol and biodiesel consumption (Transport and Environment, 2022). Moreover, the EU imports 7 percent of biomass it directly uses in biofuels and 4 percent for bioenergy overall. Imports consist mostly of rapeseed (22 percent of domestic consumption), sunflower oil (39 percent) and corn (22 percent) (Transport and Environment, 2022). Biomass for direct energy use is mostly a local market, as 93 percent of biomass is transformed in the EU country where it was grown or produced (JRC, 2019). The embeddedness of the supply chains, when accounting for by-products and waste materials, gives an even more complex picture, as confirmed by the gap in net imports estimates.

Demand for biofuels has a strong impact on food prices, especially of vegetable oils which have been a major driver of food price inflation since COVID-19 (Transport and Environment, 2022). Additional pressures came from the shock of the Ukraine war (Ukraine accounts for 40 percent of global trade in sunflower oil) and from growing demand due to national biofuel blending requirements in many member states (ePURE, 2020) as well as high fossil-fuel prices that have increased incentives to blend.

According to Transport and Environment (2022) current EU biofuel consumption accounts for 5 million hectares (when accounting for co-products) to 9 million hectares (when not accounting for co-products) of cropland, inside and outside[21] the EU, a value that corresponds to up to 8 percent of very productive total EU cropland (Eurostat, 2022b). Current EU plans would increase land use for bioenergy as a whole to a fifth of total EU cropland by 2050 (or 22 million hectares) (Searchinger et al, 2022). There is therefore competition between energy and food for land. Focusing on land that is suitable for growing biomass for bioenergy but not food is challenging in terms of practicalities and proportions (Hirschmugl et al, 2021).

Choices in bioenergy production and consumption imply trade-offs from the perspective of food and energy security and climate-change mitigation objectives. Bioenergy that can displace fossil fuels relies for the most part on wood, fuelling deforestation, and on arable crops, half of which could also feed people or animals.

Figure 10: Contribution of different forms of bioenergy to the EU gross final energy consumption 2016

Source: European Commission (2019).

3.2.2 Discourage meat production

Policymakers should consider that meat production is the most resource-intensive agri-food sector and has major negative externalities globally and in the EU. However, given the efficiency of EU meat production, reducing it without reducing EU meat consumption is likely to reduce global food security, rather than increase it. Like reducing energy crops to shift production towards food, there is a need for joined-up thinking in the areas of meat production and consumption to avoid counterproductive outcomes.

European meat production is highly productive, with trends similar to the overall agriculture sector: it is increasingly intensive and concentrated, with nearly 70 percent of utilised agriculture area occupied by the 7 percent of the biggest farms (over 50 hectares) (Eurostat, 2018). This intensity affects biodiversity, soil fertility, human antibiotic resistance and animal welfare (Nunan, 2022). The sector is also concentrated geographically. Spain, France and Germany are the main producers: Spain hosts 22 percent of the pig population and 24 percent of sheep, France hosts 23 percent of the EU cattle population (Eurostat, 2021).

Livestock production uses 71 percent of EU farmland production, when meadows, pastures and land for feed crops are included (Greenpeace, 2019). European production is the most productive in terms of land use. It is over twice as productive as Asia, where 34 percent of global land dedicated to meat production is concentrated. Since the EU imports a large share of its feed, reducing meat production in the EU could lead to decreased global land use (EEA, 2017) (especially deforestation in Latin America; see Unmüßig, 2021). However, if EU consumption were to remain constant, production would shift from the EU to other parts of the world, where more land and feed would be required to produce the same amount of meat.

European productivity in terms of tonnes of meat per hectare is also higher than other regions because production in the EU is more focused on pork and chicken than on beef. Half of EU meat production in 2020 was pork, poultry was 30 percent and beef 15 percent (Eurostat,2021).

Feed represents one third of global cereal consumption (Mottet et al, 2017); this share is the same for the EU’s cereal supply (Kelly, 2019). The EU relies largely on imports for its feed, producing only 31 percent of the total feed consumed in the EU (Polten, 2019). Soybeans and maize are the main sources of feed. The great majority of soybean is used to feed animals – 77 percent to 90 percent (Ritchie and Roser, 2021). Soybeans mostly come from Brazil, the US and Argentina. The EU is the second biggest importer after China, though by a large margin: while China imported 91.6 million tonnes of soybeans in 2021-22 (59 percent of total world trade), the EU imported 14.1 million tonnes (9 percent)[22]. Soy is the second biggest driver of deforestation worldwide, behind conversion of forest to pasture, especially in South America (Unmüßig, 2021). Of maize production, 59 percent ends up as feed (Unmüßig, 2021).

According to FAOSTAT the EU is not only relatively self-reliant for meat and dairy products (except for fish), it is also a net exporter of beef (2 percent of EU production), eggs (5 percent) and pork (exporting 11 percent of its production makes it the world’s largest pork exporter).

Replacing EU meat production by meat imports could undermine global food security, as more land will be needed in other parts of the world to produce the same amount of meat – reducing the opportunities for local food production. However, this trend could be mitigated by two tendencies in the sector: the low propensity of meat to be traded, and the consumption decline when prices of meat and meat products increase. Only 11 percent of meat products are traded globally (Chemnitz, 2021). This is partly because of the specific restrictions and sanitary complexities associated with the sector. This is also due to income levels, as shown by the steady increase in this share. Production elsewhere, or more high-standard EU production, would be more expensive and therefore less consumed (Femenia, 2019).

Overall, measures that could curb EU meat production (eg improved environmental standards) must go hand in hand with meat consumption reductions. If not, the risk is they could cause outsized negative externalities at global level, compared to the potential benefits within the EU.

3.3 Reduce consumption

To make up for the lost globally-traded food volumes, the EU could consider policies to reduce domestic consumption and food waste.

3.3.1 Reduce consumption of high input foods

The per-capita food consumption of EU citizens (3400 kcal, 781kg) is about 16 percent larger than global average food consumption (2900 kcal, 671 kg). This is explained by differences in diet composition (the EU consumes in proportion less vegetables but more meat) and by higher overall intake. Reducing consumption of food – especially meat – that is particularly intensive in inputs would increase overall food supply by, for example, allowing cereals destined for livestock feed to be consumed directly. Coordinated action across meat production and consumption in Europe would be required to achieve this.

The EU and other rich economies export their food consumption patterns. As incomes increase elsewhere, so will meat consumption (Ritchie et al, 2017). Reducing meat consumption in order to limit the growth in meat demand and production will be an inevitable component of environmental policy (Mekonnen and Hoekstra, 2012). This is in line with recommendations to make diets healthier. Ranganathan et al (2016) found that all regions exceed protein needs in average daily protein intakes, especially in developed countries, with North America in the lead. Willett et al (2016) found that on average Europeans exceed their daily intake needs of red meat (by more than four times) and eggs (two times), which are input-intensive products.

A 2021 survey showing that 70 percent of Western Europeans are in favour of increasing taxes on meat products shows that public opinion is aware of the stakes associated with meat consumption[23]. However, in the current context of high inflation, raising taxes on meat and meat products would likely be extremely unpopular. To yield the greatest gains in terms of increased food supply, while limiting strains on the environment, the foods with the lowest energy efficiency (defined as the ratio of the caloric input in terms of feed relative to the calorific output in terms animal food products) should be targeted first (Ritchie, 2021b). Beef and lamb have the lowest energy efficiency (2 percent and 4 percent); however when their diet relies on grazing, there is no opportunity cost of channelling food that could otherwise feed humans. Pork and poultry are much more energy efficient (9 percent and 13 percent), but they feed off crops that could be consumed by people, or that are at least grown on fields that could grow food.

Healthy diets not only require calories but also proteins. Animals have different capacity to convert low-protein products, such as cereals, into high protein ones. Beef ranks worst for protein efficiency by far (4 percent of the protein in animal feed inputs was effectively converted to animal product). All other animal products have a protein efficiency 1.6 to 6 times higher, including lamb (6 percent), pork (9 percent), poultry (20 percent), whole milk (24 percent) and eggs (25 percent).

While reducing meat production in Europe (if displaced by imports, see section 3.2.2) might have no positive impact in terms of food security, reducing meat consumption or shifting to more protein-efficient meat (from beef to chicken, for example) is a healthy trend that is currently underway in the EU and elsewhere (Eurostat, 2021) and can free agricultural capacity for food production. That said, ruminants such as cattle can make use of grazing land and agricultural by-products that humans cannot eat, and livestock produce manure which can replace chemical fertilisers in crop production. Hence, transformed livestock systems have a key role to play in future sustainable circular agricultural production.

3.3.2 Reduce food waste

Globally, 17 percent of food is wasted (UN, 2021). Food loss can occur at different stages, with features varying according to income levels (Gustavsson, 2011). In developed countries, food is mostly wasted by consumers, because of over-purchasing, poor meal planning and poor home storage. In developing and low-income countries, food is mostly lost higher in the supply chain, at the harvest and postharvest steps (FAO, 2019). For low-income countries, the main lever to reduce food waste is improved production and storage. For middle- and high-income economies, such as the EU, diminishing waste at household level is most effective.

In the EU, around 20 percent of food is wasted (European Commission (2022a). This is broken down into several stages of waste: by households (53 percent), in processing (19 percent), in food service (12 percent), in production (11 percent) and in wholesale and retail (5 percent). For meat and dairy products, the share wasted is 23 percent. Like overall food products, most waste occurs at the consumption stage within households or services (64 percent). The EU’s current goal is to reduce food waste 60 percent by 2030 (EEB, 2020). Reducing food waste does not have obvious trade-offs, but the policies to achieve reductions can have negative side-effects. For example, increasing the value-added tax rate for food to standard VAT rates would make food wastage more expensive for households. But poorer households would be disproportionately affected as they spend higher shares of their income on food than richer households.

An effective lever is education and communication on food. For instance, making date labelling more comprehensible can reduce some food wastage (European Commission, 2022c)[24].

Food redistribution programmes can also help to reduce waste. Redistribution generally occurs when food is sent from grocery stores (or other stops along the food value chain) to charities such as food pantries. Many European countries have already implemented such programmes, but removing legal barriers and funding the necessary structures could allow more people in need to receive food while reducing food waste[25].

3.4 Improve allocation

As described in the introduction, the current episode of food insecurity is not primarily a result of a global food-supply-demand imbalance, but of a number of vulnerable countries finding it hard to displace shortfalls in imports from Ukraine through their own production or alternative international supplies. Hence, improving the allocation of the available food can effectively address the current crisis.

3.4.1 Opening trade routes: getting the grain out of Ukraine

The EU can commit more political and financial capital to facilitate grain exports from Ukraine, partly to the detriment of its domestic farming lobbies, which would prefer to increase their own market share (rather than sharing logistics with the Ukrainians).

As detailed in section 2, pre-war Ukraine was an important player in the international grain trade, exporting 5 million to 6 million tonnes of grain per month, 90 percent of which was through the Black Sea[26]. Shipments have resumed since July 2022, but remain below pre-war volumes. Ukraine needs to support this important sector of its economy (agriculture was 9 percent of GDP and 40 percent of exports pre-war; OEC, 2020). To this end, maximising the volume of exports through the Black Sea grain corridor, and continuing to expanding grain exports via the land route through the EU, is of great importance. While the time for planting 2022-23 winter crops, such as wheat, has come to an end, there is still hope that Ukrainian farmers, if they are able to generate revenues in the coming months, will be able to plant more summer crops, such as corn and sunflower, in spring. For the global food security outlook, boosting grain export volumes from Ukraine and ensuring the largest possible crop next year would alleviate some price and supply pressures, as Ukraine accounted pre-war for around 10 percent of globally traded cereals.

To Ukrainian grain can reach international markets, support from the EU for alternative trade routes remains important. Options are other countries’ ports, especially Constanta in Romania but also Gdansk in Poland and Rostock in Germany, which are connected by road and rail to Ukraine. To get to these ports, avenues include land routes, through Poland mainly, and waterways, through Ukrainian ports on the Danube. So far, all routes and transportation modes have proved challenging and unable to channel volumes comparable to those through Ukrainian ports in the past[27]. The challenges and bottlenecks are multifaceted, including lack of workforce, damaged infrastructure in Ukraine, lack of interconnectivity of infrastructure as railways are not compatible across countries, red tape, corruption and saturated facilities in the ports of substitution in Poland, Romania and Bulgaria. These constraints translate into longer and more expensive routes that substantially erode the margin of farmers. In parallel, acknowledging the logistical deadlocks, the US and the EU have announced plans to build silos to store the grain from the upcoming harvest to limit losses due to spoilage[28]. In the medium to long term, actions to improve Ukrainian infrastructure and connectivity will be important to ensure supply-chain reliability (European Commission, 2022d). In the short term, it is crucial to ensure food security in Ukraine, including by ensuring that farmers in Ukraine can operate profitably.

3.4.2 Humanitarian aid: supply more food and increase local production

The United Nation’s Global Humanitarian Overview report of June 2022 identified that, following COVID-19 and the invasion of Ukraine, global humanitarian needs reached new highs (UN, 2022). The number of people in need of assistance increased to 274 million, and the funding requirements to $38 billion. The funding gap reached an all-time high of $20 billion.

Agriculture is the most underfunded sector. Given higher food and energy prices, providing the same level of relief requires more funds to be mobilised. Operating costs for the UN World Food Programme have increased by $74 million a month – 44 percent more expensive than in 2019 (WFP, 2022a).

In the short term, the crisis will hit food security twice: first through the hike in food prices and then through input price growth (fertilisers, fossil fuels). In stark contrast to the impact on Europe, which will primarily be in the form of higher prices, input price growth is highly aggravating as it leads to diminished output, especially in poorer countries (WFP, 2022b). For instance, the WFP estimates that cereal production could drop by as much as 16 percent year-on-year in East Africa (WFP, 2022b). These shortfalls will translate into more food imports, which will put depreciatory pressures on the currencies of those countries and in turn import more food-price inflation, in a context in which many countries are already in debt distress in the COVID-19 aftermath. For Africa as a whole, weather and political conditions are projected to lead to an overall decrease in cereal production of 4 percent year-on-year (FAO, 2022). Latin America is highly exposed to the price and supply shocks, but is in somewhat better position thanks to an expected increase in overall cereal production (FAO, 2022). However, high international prices create more incentives to export and thus do not alleviate food insecurity challenges, especially given that the increase is driven by maize, which is mainly exported.

Betting on additional imports from Europe is financially costly and perpetuates the food and financial dependency of vulnerable countries for the potentially difficult years to come. Yields need to be boosted within countries that are at direct risk of famine. Though some countries that are vulnerable to these shocks have high wheat yields – for example Egypt (6680 kg/ha), relative to Germany (7800 kg/ha) and France (6680 kg/ha) – others have extremely low wheat yields. These include Lebanon (3415 kg/ha), Ethiopia (2995 kg/ha) and Yemen (1763 kg/ha) (FAOSTAT, 2022). Questions arise about how yields and output can be boosted.

The potential to increase self-sufficiency in many developing countries is high. This could be done by increasing the amount of agricultural land and, more importantly, by increasing production yields. Of uncultivated arable land globally, 60 percent in located in sub-Saharan Africa (Ayodimeji, 2022). Africa as whole has an average yield per hectare that is 60 percent below the global average, and 95 percent below that of the EU (Ritchie, 2022). Sub-Saharan African value added per worker in the sector is also 60 percent below the global average, and 70 percent below that in the EU. From 1980 to 2018, yields in South Asia increased by 140 percent, but only by 40 percent in sub-Saharan Africa. Yields need to be increased to limit the growth of cultivated land but also to support development, which starts with people having the means to exit agricultural jobs. In sub-Saharan Africa, on average, 54 percent of the workforce is employed in agriculture (Sow, 2017). Access to inputs including seeds, fertiliser (Thomas, 2020), irrigation and machinery (Epule et al, 2018)[29] is the way to increase productivity. In the seven years to 2017, yields increased by 30 percent in China and 100 percent in Brazil (Ritchie, 2022). Overall, this is an economic development topic. Historically, across almost all places and times, productivity growth in agriculture has been accompanied by growth in the size of farms and reductions in the share of employment in agriculture and the share of the population living in rural areas. These processes need to be supported by economic development in other sectors.

Providing access to European fertiliser implies hard trade-offs with production in other (possibly more productive developed) countries (see section 3.1.2). Ensuring access to high-quality seeds (which generally are resilient against diseases and insects and have high yields) is also a potent lever with less risk of environmental trade-offs. Financial instruments enabling farmers to borrow the needed (and often unusually pricy) seeds, fertiliser, pesticides, machinery and labour, against uncertain future harvest revenues, could allow substantially higher production.

Pledges by NATO-aligned countries, including through the G7 and the World Bank, are being made. They intend to focus both on food distribution and enhancing production capacities, anticipating shortfalls as input prices rise. The G7 has pledged to mobilise $4.5 billion in funding for food aid, along with the World Bank pledging $30 billion in new and existing projects (World Bank, 2022b). An advance was made at the 12th Ministerial Conference of the WTO in June as WFP food purchases were exempted from export restrictions. At the EU level, France announced the FARM initiative in spring 2022[30]. The three pillars of this are: ease trade tensions on agricultural markets, solidarity with Ukraine, and strengthening production capacity in countries affected by food crisis. Before the war, the European Union’s annual food aid (from the European Commission and individual EU countries) generally ranged from €1 billion to €1.4 billion (from 2016-2021). In late June 2022, the EU allocated €600 million of aid to food security, including €150 million in humanitarian assistance and €350 million for medium to long term investment to support local agriculture production.

These initiatives must be sustained to prevent greater food insecurity through unpredictable policy shifts. Monitoring remains important as in many low-income and developing countries, food inflation is reaching three digits or more and protests are already happening[31]. Aid programmes also must be considered in the geopolitical context of confrontation with Russia, again pointing to the need for coordinated decision making across multiple policy fronts[32].

3.4.3 Trade policy: reducing protectionist measures

Trade in agricultural products remains one of the most contentious areas of world trade. Distorting trade policies include export restrictions, taxes and embargoes. Recurring tensions focus on developing countries criticising both the subsidy programmes and import restrictions of developed countries.

The current context has exacerbated protectionist measures that seek to secure domestic food supplies and stabilise prices. Export restrictions affect 17 percent of globally traded calories (Laborde, 2022b) – including 13 percent through export bans and the rest through export licensing – compared to 9.8 percent in 2020 and 18.7 percent in 2008 (Glauber et al, 2022). Countries in Central Asia, the Middle East and Africa are particularly impacted. Similar stakes are unfolding in the fertiliser sector. Such bans are successful for domestic objectives but make others worse off (Kleimann, 2022).

Adverse protectionist tendencies might be mitigated by diplomatic efforts to promote cooperation and trust-building, and campaigns for transparency to encourage countries to lower their barriers to trade. In the longer term, the international community would benefit from increased communication and cooperation on food and energy policies. But, while the EU would not necessarily lose out from pursuing a reduction of protectionist policies in agricultural trade, decades of complex international negotiations – for example in the stalled Doha Round of WTO negotiations – have shown that sustainable progress is hard to achieve.

4 Concluding remarks

Food security in many vulnerable countries is currently being challenged by a geopolitical shock that is completely outside of those countries’ control. In the short term, it is both a humanitarian imperative and also strongly in the European interest to mitigate the immediate shock. But European policies to address short-term food insecurity should not be implemented at the expense of resilience to future shocks – as might arise from climate change.

Our categorisation and basic assessment of European policy options to address food insecurity in the wake of the Russo-Ukrainian war highlights that:

- Solutions come from several different policy areas;

- Solutions individually are insufficient and hence need to be combined;

- Solutions typically imply substantial trade-offs with other policy goals, and some ‘intuitive solutions’ could backfire.

The complexity of some of the interactions across sectors (in particular food and energy), over time (short-term productivity gains from using set-aside land versus long-term productivity losses from lost biodiversity), across consumer groups (rich vegetarians versus poor meat-eaters), across EU countries (Romanian grain farmers might lose out from opening trade routes for Ukrainian grain, while Spanish pig farmers might gain) and across continents makes finding efficient and politically feasible solutions more difficult.

In the short term, our main recommendation is that the current situation of food insecurity can only be properly addressed by a combination of options from different policy areas, ie it is not the responsibility of agriculture ministers alone. Clear coordination and prioritisation are required to find a policy mix that minimises the adverse effects and potentially even enables some side-gains.

In our view, in the short-term, policies to maintain and expand trade routes from Ukraine, to enable increased food production in vulnerable countries and to reduce harmful consumption in the EU, are best suited to address the current challenges. Meanwhile, bringing fallow land into production and shifting production in the EU have clear trade-offs. Finally, completely doing away with fallow land or massively subsidising fertiliser usage in the EU are likely counterproductive. In all those cases, the design of the policy matters for the outcome.

In the long-term the concluding recommendation is to strengthen resilience, mainly by reducing extensive rigidities in the system. Shocks need to be absorbed by a system that can reprioritise production of food quickly, and countries need to be able to rely on a liquid global market to obtain alternative imports in case of local shocks. That is, policies should not hardwire production choices for long periods, but should rather protect flexibility in production and consumption. In the longer-term infrastructure that increases resilience, such as storage facilities (in low-income countries especially) and monitoring systems can be relatively low-cost investments in smoothing out adverse events. To reprioritise production and ensure equitable access to food, policies should address food waste and unsustainable food practices, including excessive meat consumption.

Table 3: Summary of the policy toolbox

| Pre-Ukraine war context | ||

| Global agriculture trade pre war | Global cereal production:

Cereal trade:

Vegetable oil trade:

|

|

| Global use in cereal supply | Global level (Ritchie, 2021b) :

|

|

| Ukrainian blockage |

|

|

| Export restrictions |

|

|

| EU Policy | Potential gains | Potential losses |

| Increase production | ||

|

|

Short term:

Long term:

-> Crucial that this measure only last for 1-2 years. |

|

Short term:

|

Short term:

Long term:

|

| Shift production towards food | ||

|

Short term:

|

Short term:

|

|

Long term:

|

Long term:

|

| Reduce consumption | ||

|

Long term:

|

|

|

Long term:

|

Short term:

Budget to be allocated for information as 61% of waste happens in households globally (53% in the EU) |

| Improve allocation | ||

|

Short term:

Long term: – reliable export routes increase Ukrainian farmers incentives/ability to produce in coming years. |

Short term:

|

|

Short term:

|

Long term:

|

|

Long term:

|

Short term:

|