There have been calls for the EU to implement a ban on Russian energy imports in response to the Ukraine war. Maciej Miniszewski assesses whether such a ban would be feasible.

Last year, revenue from the export of energy commodities to the EU accounted for over a fifth of the Russian budget. This directly funded Vladimir Putin’s war machine. It is unsurprising therefore that the Russian and Belarusian attack on Ukraine has renewed discussions over the EU’s independence from Russian energy. We now find ourselves at a historic moment with the chance of securing a breakthrough in EU energy policy.

Russia accounts for 25% of the EU’s oil imports, 45% of its natural gas imports, and 44% of its hard coal imports. EU imports of Russian fossil fuels were worth around 150 billion US dollars in 2021. The EU can move away from fossil fuel imports from Russia, but this will require energy solidarity between EU countries.

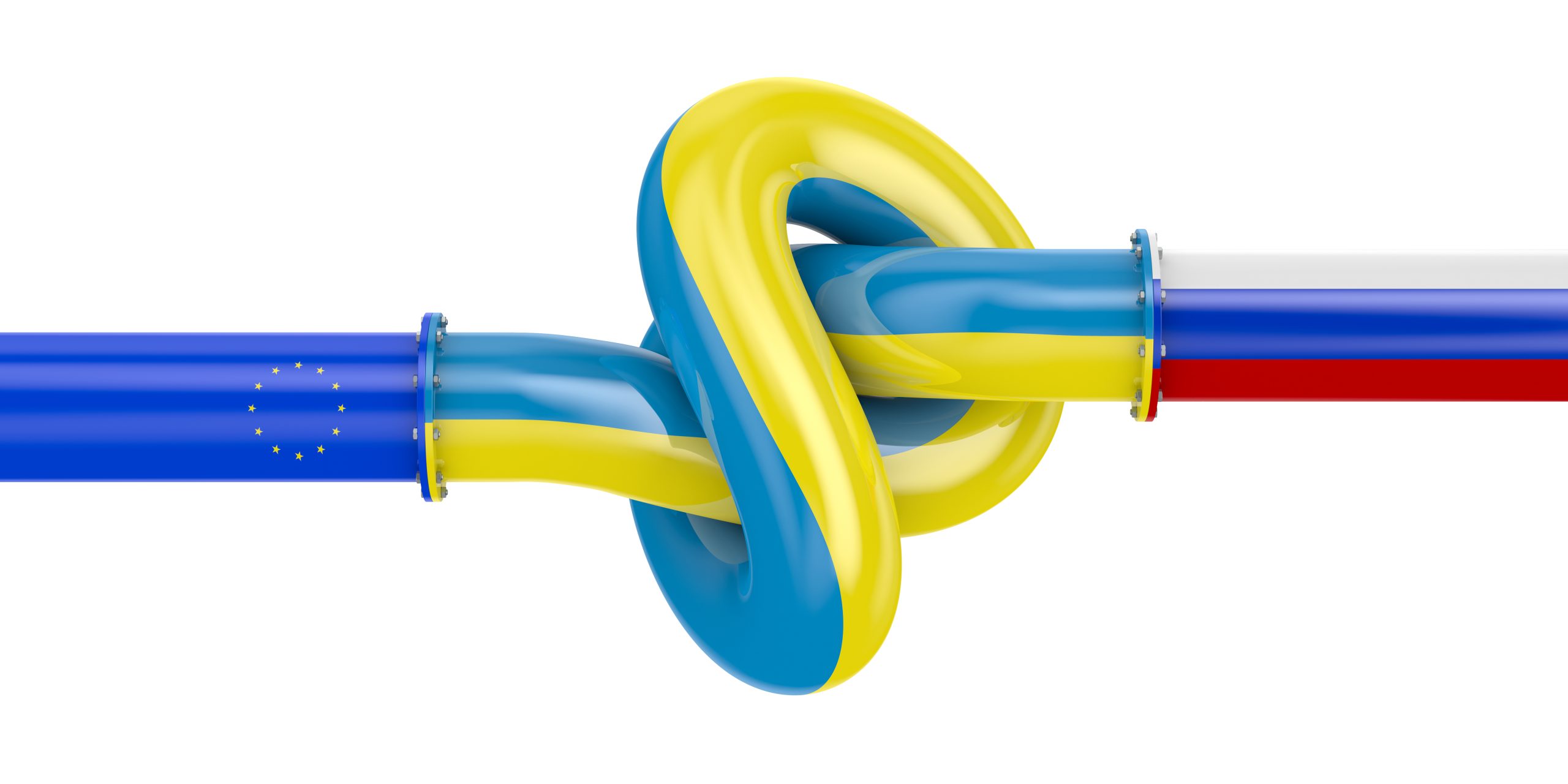

The structure of dependence on Russian fossil fuels varies between countries. Central and Eastern European countries are the most dependent on oil, in terms of the share of consumption (as shown in Figure 1). Yet supplies to the Naftoport Polish Oil Terminal in Gdansk offer them some security.

Figure 1: Central and Eastern Europe is more dependent on Russian oil

Source: Prepared by the Polish Economic Institute using Eurostat data.

It will be more difficult for Germany and the Netherlands to ban Russian oil imports because they have not managed to build up sufficient diversification potential in the past. European countries, including Germany and France, are also highly threatened by a potential shortage of Russian gas (as shown in Figure 2).

Figure 2: Medium-term risk for winter 2022/23 if countries were to move away completely from Russian gas supplies

Note: Countries shown in red are high risk countries with insufficient storage capacity, limited opportunities to diversify supply, and a low level of storage facilities (below 30% of the total required). Yellow denotes medium risk countries which have two of these three risk factors. Assessment prepared by the Polish Economic Institute based on data from the GIE aggregated gas storage inventory and the ENTSOG transparency platform (accessed 9 March 2022).

OECD members have 1.5 billion barrels of oil, enough to replace Russian exports for a year. Industrial holdings control an additional 3 billion barrels. The EU’s emergency oil stocks can meet demand for 90-100 days. The International Energy Agency (IEA) has agreed to release 60 million barrels of oil from its emergency reserves. Despite certain supply issues in global coal markets, Russian coal can be replaced because there is a large and flexible supply.

Replacing Russian gas is more of a challenge. The EU’s strategic reserves are not yet ready. Even according to a very optimistic scenario, in which existing storage facilities are filled to 90% of capacity at the peak of the winter season, as many as 14 of the 27 EU countries have reserves for fewer than 30 days of average imports (over the course of a year).

On 8 March, the US and Britain introduced a ban on purchasing oil and refining products from Russia. This will reduce Russia’s annual budget by more than 10 billion US dollars, based on revenue from 2021. The European Commission’s plans to reduce deliveries of Russian gas by two-thirds by the end of this year, announced the same day, will cost Russia an additional 30 billion US dollars. Poland announced the first plan in the EU to wean itself off fossil fuels from Russia later this year, which could deprive the Russian budget of over 12 billion US dollars per year. On 7 April, the European Parliament adopted a resolution calling for an immediate embargo on Russian energy resources. This puts pressure on countries for further action at the EU level.

Russian oil is not covered by the sanctions, but nobody wants to touch it. According to IEA forecasts, as of April 2022, 3 million barrels per day of oil and petroleum products from Russia may not find a market outlet. This creates the risk that Russian oil will be re-registered to avoid sanctions. During the first days of April, according to statistics from the Marinetraffic platform, no data from the Automatic Identification System (AIS) had been recorded for 431 of the 710 registered Russian tankers with a total carrying capacity of more than 26.4 million barrels.

The price differential between Urals crude and European Brent crude has increased more than fivefold since the start of the war. Unfortunately, there are still several buyers of Russian oil in the EU. Russian refineries in the EU consume 1.23 million barrels per day. Hungary has also stated that it opposes an embargo. Hungary’s state-owned MOL refineries process more than 0.21 million barrels per day of Russian crude. In addition, refiners in the Netherlands, Germany and Greece have declined to comment on the EU directive.

Figure 3: Price difference between Russian Urals crude oil and Brent, Dubai and WTI crude oil in US dollars

Note: The figure uses oil futures prices from 1 January to 1 April 2022 for Brent, Dubai Crude Oil (Platts) and WTI oil. Calculations by the Polish Economic Institute based on data from investing.com (accessed on 4 April 2022).

The EU has a chance to move away from Russian fossil fuels through diversification, substitution, and reduction. There are several sources of oil, gas, and coal imports. The EU imports around 3 million barrels of oil per day from Russia. This could be replaced by fuel from the US (0.8-1 million barrels per day) or Iran, after successful negotiations (1.3 million barrels per day), and by reshaping supply chains from Canada, Norway, the UK, and Denmark (0.8 million barrels per day).

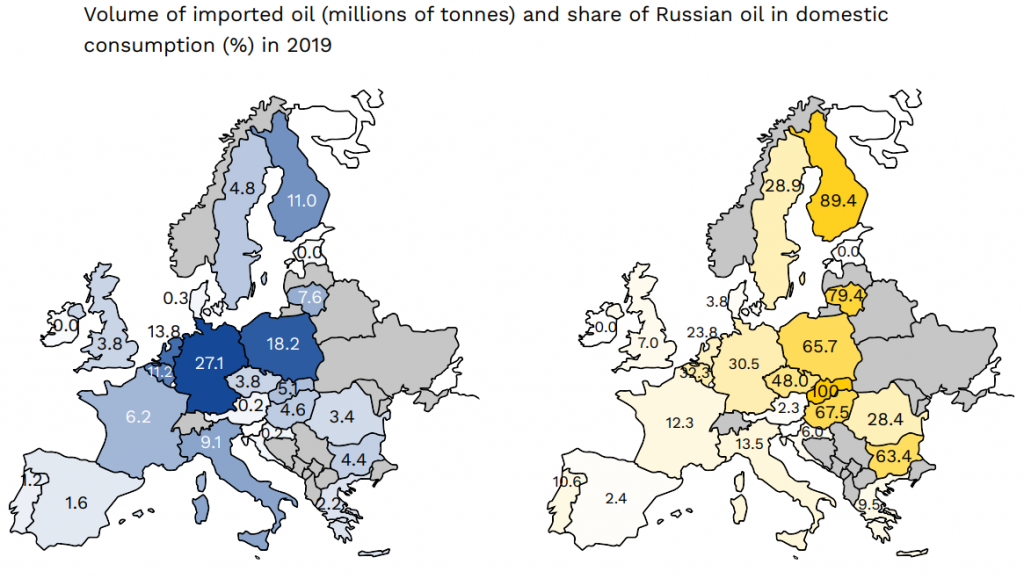

According to our calculations, Russian gas imports to the EU could even be reduced by more than 90% this year. Increasing liquefied natural gas (LNG) imports could provide around 50 billion cubic metres. Importing more gas from Azerbaijan, Algeria, and Norway could generate an additional 10 billion cubic metres. Around 13.5 billion cubic metres of Russian gas might not be replaced this year. For coal, the most popular alternative suppliers are Australia and Colombia. Pakistan and India’s policy of independence in terms of coal supply means that almost 50 million tonnes from South Africa will be freed up.

As consumers, we can impose our own sanctions on Russian fossil fuels in heating and transportation. Lowering the temperature in buildings by one degree Celsius during the heating season and reducing air conditioning in the summer by two degrees Celsius could reduce gas usage by almost 20 billion cubic metres. Government support is needed for the replacement of heating sources and thermal modernisation of residential and commercial buildings, which could reduce the demand for Russian gas and coal. Figure 4 below shows a set of recommendations by the Polish Economic Institute for replacing 137.5 billion cubic metres of Russian gas in 2022.

Figure 4: Recommendations for replacing Russian gas in 2022

Note: Recommendations based on the Polish Economic Institute’s own analysis and proposals by the European Commission and International Energy Agency.

What is more, reducing oil usage in travel-related activities could save almost 2.1 million barrels of oil per day, according to the IEA. Proper management of public transport systems and encouraging people to use them, eco-driving, ensuring vehicles have the correct tyre pressure, removing unnecessary heavy objects from cars, vehicle sharing, and lowering the speed limit on motorways could also lower the demand for fuel.

Europe faces a daunting task in which the only right option is to become independent of fossil fuels from Russia. It is a choice between short-term gains over long-term security. Our overview of alternative suppliers shows that independence is possible.