In this paper, Georg Zachmann and Conall Heussaff set out a framework for evaluating the many interrelated issues in the current EU electricity market reform.

Executive summary

In an environment of record-breaking electricity prices driven by a gas supply shock and below-average electricity generation, reforming the design of the European electricity market is seen as a means to delink consumer costs from volatility in short-term power markets.

Electricity markets should meet three objectives: fairness, optimal investment and optimal operation. The current market design has achieved these objectives to varying degrees. Faced with the unprecedented shock, the electricity system has operated well, but electricity markets have struggled to achieve fair outcomes and investments have not been driven by market-based cashflows.

Further complicating market reform, the power system is being changed radically by decarbonisation. The electricity system is becoming more decentralised and digitalised, with an active demand side. These transformations will have consequences for the optimal electricity market design in the later stages of the energy transition.

Reform proposals have focused on increasing the share of long-term contracts in the remuneration of generation technologies. Different long-term contracting regimes have structural implications for the functioning of electricity markets, especially in relation to the roles of the state and the market, and the responsibilities of national governments and European Union institutions.

A phased approach should be taken to EU electricity market design reform. In the near-term, reform should seek to protect consumers and drive investment. An assessment should also be made of what market design will best meet the fairness, investment and operational objectives in a decarbonised system, and what the conceptual role of electricity markets should be during the transition. This process should start as soon as possible so well thought-through proposals are available when the next European Commission takes office.

1 Introduction

Electricity market design is a central political issue in 2023. Electricity consumers face record energy costs, and the European Union has promised to address these through market design changes. A plan to reform the EU’s electricity market design was published on 14 March 2023 (European Commission, 2023).

More structurally, electricity market design is one of the EU’s main instruments for an efficient transition to a climate-neutral energy system, reliant on clean electricity. Properly designed electricity markets can incentivise the deployment of clean-energy technologies, including renewable generation capacity, and the flexible assets needed to support them, thereby maintaining security of supply. Market design can also help ensure the efficient and safe operation of the electricity system, which will increasingly become the backbone of decarbonised economies. In addition, electricity markets can help to distribute the costs and benefits of the electricity system fairly.

In this paper, we set out a framework for evaluating the many interrelated issues in the current EU electricity market reform discussion, including the objectives that should be defined for electricity markets and the implications of certain reform ideas. We propose a phased reform process that can meet the near-term needs while preparing the EU electricity market for the system of the future. We start by discussing key conceptual choices when designing electricity markets, the issues electricity market design should address and the link between gas and power prices. We then review the market reform debate (section 2), propose three objectives for electricity markets (section 3), discuss key aspects of power system transformation (section 4) and assess how these transformations affect the market objectives (section 5). The broader implications of the reform proposals are then discussed in section 6. Section 7 sets out our proposal for phased reforms.

1.1 Key conceptual choices

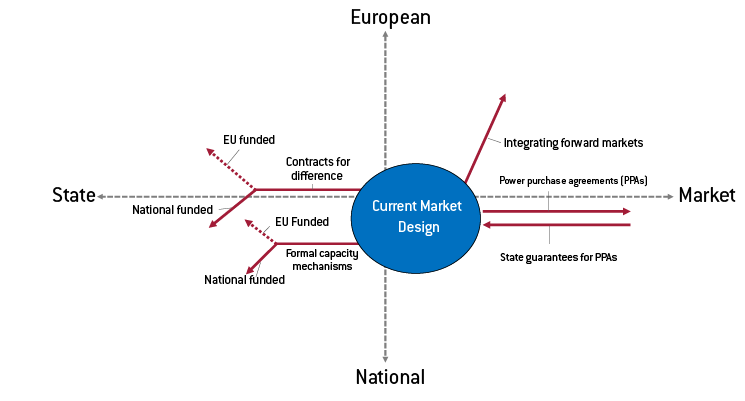

Fundamental questions for electricity market design, especially as the energy transition accelerates, include the optimal balance between state-led planning and market incentives, the extent to which the state should take on investment risk, the relative role of European and national decisions as well as the choice between more decentral bilateral exchanges versus more central clearing. The proposed instruments would likely shift the current balance (Figure 1). But these conceptual implications for the European electricity sector are currently not part of the conversation – indicating a risk of dilution of responsibilities.

Figure 1: Implied conceptual choices of reform proposals

Source: Bruegel.

To avoid a scenario in which Europe takes fundamental decisions for the future of its electricity system with inadequate understanding of the consequences, we argue that the conceptual implications of each reform proposal should be discussed explicitly at this critical juncture. A long-term reform process should also be initiated to give enough time for deep assessment of the optimal role of electricity markets during the energy transition.

1.2 What problem does electricity market reform address?

The reform debate is taking place at a time of record high consumer electricity prices in Europe. Meanwhile, many utilities are earning record revenues and profits (Figure 2). Given this situation, the reform priority for many stakeholders is fairness.

Figure 2: Domestic electricity prices and European utility revenues, H1 2021 vs. H1 2022

Source: Bruegel based on Eurostat, IEA.

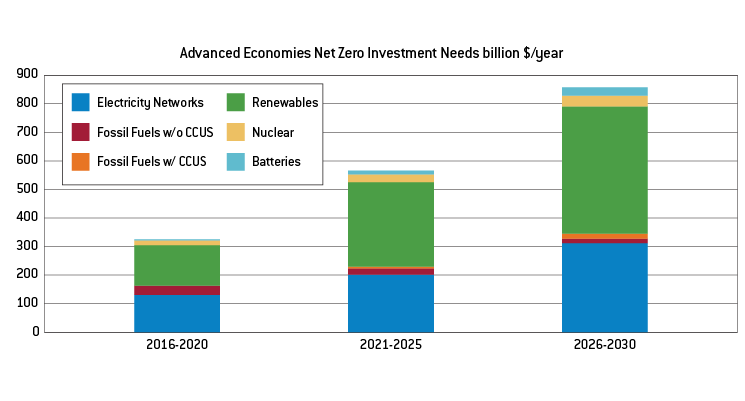

Another vital aim for electricity markets is to send clear investment signals in relation to the technologies needed to decarbonise the power system. Measures that could reduce consumer costs in the short-term could also hold back the energy transition. The electricity market and its associated institutions must therefore provide clarity and certainty for investors, while also ensuring fair outcomes. To reach net zero, the scale of investment in Europe and across the globe will need to drastically ramp up in the coming years (Figure 3).

Figure 3: Investment needs to meet net-zero

Source: Bruegel based on IEA Net Zero Emissions by 2050 scenario.

Wholesale market design is only one lever to shape fairness and efficiency in the electricity sector. The ultimate financial flows between electricity market participants depend strongly on the multiple wholesale market segments, and also on the regulation of network access and remuneration, retail market design, and taxes, levies and subsidies. In line with the ongoing debate, we focus primarily on the wholesale market but also discuss retail markets and other aspects.

1.3 The link between gas and power

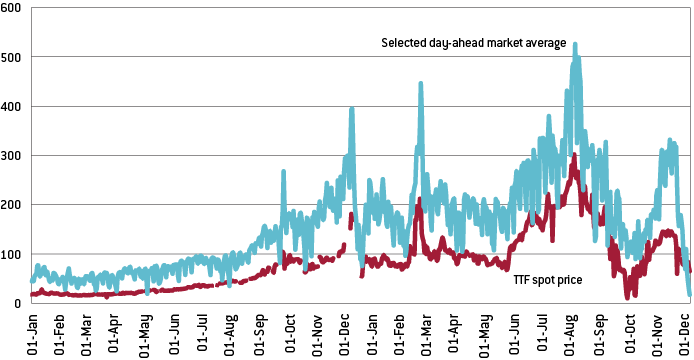

At the root of the energy crisis is a gas-supply crisis. Faced with huge cuts to pipeline gas from Russia, European countries have been forced to purchase their gas supplies on international liquefied natural gas (LNG) markets at a significant premium. Because of the European electricity generation mix and the pricing mechanism in electricity spot markets, these gas-price increases have translated into electricity price spikes. Figure 4 shows the spot price at the Title Transfer Facility (TTF), Europe’s major gas trading hub, in 2021 and 2022, and an average of the Dutch, French, German, Spanish and Polish day-ahead market prices over the same period. The link between gas and power is clear[1].

Figure 4: 2021 and 2022 TTF spot price and day-ahead market prices

Source: Bruegel based on ENTSO-E and Bloomberg.

The link arises firstly and most importantly because gas-fired power generation makes up a large proportion of European electricity production (20 percent in 2022, surpassed only by nuclear, although the share of gas is projected to fall; Ember, 2023). Gas provides crucial flexibility to meet peak electricity demand, especially during periods of low wind and solar availability. As the cost of gas has increased, so has the cost of electricity generated with this fuel.

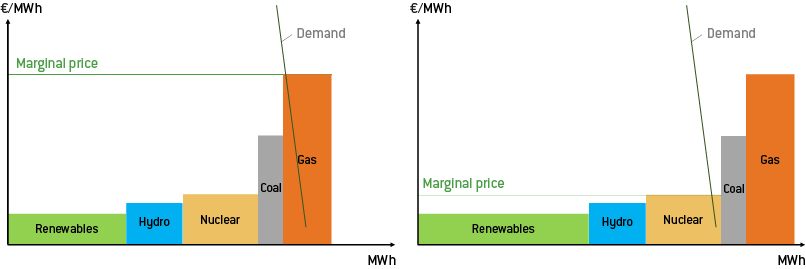

Secondly, European spot markets prices are determined according to the so-called merit order model (Figure 5, left panel). The price of electricity in a given time period is determined by the marginal cost of the most expensive generator needed to meet the demand in that period. This approach minimises the cost of supplying electricity to meet a certain level of demand, as it ensures the least expensive generators are used. However, since gas-fired generation is in many hours the so-called marginal generator (ie the most expensive generator), the cost of gas often determines the marginal electricity price. As gas plants require about two megawatt hours of gas to produce one megawatt hour of electricity. the marginal cost of one megawatt hour of electricity produced by gas is about twice as high as the price of one megawatt hour of gas (plus the carbon cost). This drives the correlation between gas and electricity seen in Figure 4.

However, the electricity price is not dependent on the gas price by definition, as the correlation only arises when gas is the marginal generator.

If the electricity-generation mix is changed by adding more renewables, run-of-river hydropower or nuclear (so-called ‘inframarginal’ generators), gas generation is pushed out of the merit order (Figure 5, right panel). The marginal price is set by gas generation in fewer periods as the share of generation from other sources increases[2]. The implication is that by increasing investments in low variable cost generation and sufficient storage, and by enabling consumers to shift demand, the link between gas and power can be decoupled, without necessarily making changes to the market design.

Some countries (Greece, Spain) and even the president of the European Commission[3] in 2022 have advocated structural interventions to decouple prices from marginal cost, but the debate in early 2023 seems to accept that interventions (such as applying average prices for market clearing, subsidising marginal technologies or creating technology-specific markets with different prices) would need to be extremely carefully designed to limit the negative impact on the efficiency of market outcomes. For some discussion of the options see Heussaff et al (2022).

Figure 5: Stylised merit-order model with different renewables shares

Source: Bruegel.

2 What has been proposed?

2.1 Categorisation of reform proposals

The debate on electricity market reform includes some long-considered ideas and some new ideas, broadly categorised as follows.

Encourage long-term contracts

Many reform proposals focus on increasing the share of various types of long-term contracts, in order to delink the price received by electricity producers from spot markets.

The forward market could be improved. At present, there is limited trading beyond short time horizons, making it hard for participants to hedge. Improvements could be made by providing standardised, longer contracts and driving additional liquidity onto platforms, for example by facilitating improved coupling across borders in forward markets (Meeus et al, 2022). Removing barriers to more bilateral contacts between generators and consumers is suggested as a means to allow market participants to hedge their positions sufficiently.

Expanding and improving state-backed contracts for difference (CfDs, see section 6), tendered via competitive auctions, is advocated by several European countries, including France and Spain. There are several options for applying such schemes, either by making them optional for new projects, mandatory for all new developments, or even requiring all existing and new projects to sign a CfD.

Capacity mechanisms[4] are a means to support the reserve capacity needed to meet peak demand. Such capacity is often only needed for short periods and cannot recover its costs from the spot markets. At present, state-aid approval is required to implement such mechanisms because of the risk that they could be used uncompetitively to support unviable technologies. Spain and Poland have called for formal recognition of the need for capacity mechanisms (see Annex 2).

Adjust pricing mechanisms

Another proposed means to decouple the consumer price of electricity from short-term volatility is to alter the pricing mechanism in the wholesale markets. Variations of this approach were approved as emergency measures in 2022 under Article 122 of the Treaty on the Functioning of the European Union.

The first of these emergency measures is the so-called Iberian mechanism, a joint scheme applied in Spain and Portugal that subsidises the fuel costs of gas and coal powerplants to insulate the electricity markets from exceptional gas prices. The Iberian countries have requested an extension to the measure[5] and Portugal has proposed pan-EU implementation of a similar ‘emergency clause’ that would set an upper limit on spot market prices in certain circumstances (see Annex 2).

Another emergency measure is the inframarginal revenue cap, approved by the Commission for implementation at member-state discretion (Council Regulation (EU) 2022/1854). The revenue cap does not directly change the spot market price but instead limits the revenues that technologies with low variable cost can earn from the market.

Other changes to the pricing mechanism include remunerating generators on the spot market based on their individual bids, rather than the clearing price (the price of the most expensive generator), or paying generators the average of the marginal cost of all generators. However, the consensus is that such approaches would create incentives for inefficient behaviour and are therefore not under consideration.

Split markets

Another rather radical approach takes further the ideas on long-term contracts and changes to the pricing mechanism. Split markets would remove certain technologies from the spot markets entirely, and instead have them compete for long-term contracts via auction. A Greek proposal (Council of the European Union, 2022) has referred to this as a “when-available” pool (primarily renewables) and on-demand market (made of dispatchable fossil fuels and hydro), while Grubb et al (2022) called a similar idea a “green power pool”. The intention is to provide renewables with long-term price certainty while pushing down consumer costs, closer to the average cost of supplying electricity. At the same time, fossil-fuel plants would continue to compete on spot markets.

Retail reforms

On the retail markets, the Commission has provided guidance on emergency support, allowing for regulated price setting and recommending certain support measures in an emergency regulation approved in October 2022[6].

Providing consumers, from households to industrial companies, with greater opportunities to hedge their consumption is widely considered to be a necessary reform. One proposal is to require suppliers to hedge a certain proportion of their consumption and to offer fixed-price contracts to ensure that end-consumers are to an extent protected from spot-market volatility.

Insulating consumers from short-term price signals contradicts the long-held goal of encouraging greater demand flexibility. However, Glachant (2023) and others have discussed potential means of both protecting consumers from volatility and creating incentives for demand response, for example by limiting total consumer costs to a fixed level, but allowing consumers who reduce their consumption to pay less than the cap.

2.2 Legal basis

The most recent electricity market reform only dates back to 2019. This so called Clean Energy Package was essentially the fourth electricity market package after reforms in 1996, 2003 and 2009. It comprised the Electricity Directive (EU) 2019/944 and Electricity Regulation (EU) 2019/94. The Electricity Directive (EU) 2019/944 amended the previous Electricity Market Directive (2009/72/EC) and focused on further integrating electricity markets through cross-border trade and harmonised rules, and on enhancing market competition between suppliers. The Electricity Regulation (EU) 2019/94 sets out the rules for the operation of electricity markets, including price formation in wholesale markets and responsibilities in the balancing markets[7], as well as cross-border capacity allocation, network charges and design principles for capacity markets. Finally, the current market design discussions also entail revision of Regulation (EU) No 1227/2011 (REMIT), which covers market integrity and transparency through the collection and monitoring of market data.

2.3 The proposed reform

The European Commission proposed a reform of the electricity market design on 14 March 2023 (European Commission, 2023). The main thrust is to encourage more long-term contracts by letting governments bear some of the risk of power purchase agreements (PPAs)[8] and recommending CfDs as the default instrument for provision of state support to non-fossil generation. Moreover, transmission operators should create centralised markets for flexibility.

To improve liquidity in forward markets the Commission proposed creating regional trading hubs or forcing market operators to buy and sell products themselves. The Commission also proposed to adjust retail markets in order to better protect consumers, including by requiring suppliers to offer fixed-price contracts and to ensure that their consumption is sufficiently hedged, facilitating energy sharing between consumers and allowing governments to set consumer prices during specific crisis periods, which are to be determined by the Commission. Overall, the proposal strengthens protection for consumers while formalising the right of EU governments to prop up/securitise the cashflows of domestic investors.

Prior to its proposal, the European Commission sought input via a consultation[9]. The Commission highlighted issues of unaffordability for consumers as a consequence of an inability to hedge against high prices, and the importance of tools for incentivising the uptake of long-term contracts. Long-term contracts were framed as a means to shift consumer prices to more stable long-term arrangements and to provide clear investment signals.

A response to the European Commission’s consultation from the European Union Agency for the Cooperation of Energy Regulators (ACER) and the Council of European Energy Regulators (CEER) advocated the development of forward markets. ACER and CEER set out the opportunities and risks of state support schemes, while opposing the wholesale market revenue cap and supported the idea of allowing European countries to enforce obligations on suppliers to ensure they are adequately hedged (ACER and CEER, 2023).

Early in the energy crisis, as gas prices began to increase because of reduced flows from Russia, ACER was tasked with assessing the EU market design. ACER (2022) subsequently recommended that the current design be retained, but its development be continued. ACER (2022) listed 13 measures for consideration by policymakers, many related to improving long-term markets and protecting consumers from extreme volatility and price shocks.

3 Electricity market design objectives

Electricity market design should fulfil three objectives: fairness, optimal investment and optimal operation.

3.1 Fairness

The way in which electricity markets are designed has distributional consequences. If prices are artificially unitised across wide geographical areas, consumers in energy-abundant regions pay higher prices than they would if their region were a separate bidding zone, while consumers in energy-poor regions gain. If a certain supply-security level is fixed, consumers who do not need it still have to pay for it, to the benefit of others. Excluding specific market participants from certain system costs (eg domestic PV paying less for networks, or large consumers not paying certain levies) has strong distributional effects, and so on. The magnitude of the distributional effect is substantial and can be illustrated by the fact that in the first half of 2022, heavy industry in France pays twice as much as small households, while in the Netherlands households pay four times more than industry[10].

Electricity markets should help to fairly distribute the costs and the benefits of the electricity system, even in extreme circumstances. Consumers, including households, small business and industry, should be able to protect against swings in energy costs. Massive increases in prices could otherwise result in energy bills that drastically shrink the disposable income of households, or squeeze out structurally competitive businesses, thereby contributing to macroeconomic instability. On the other hand, generators need access to instruments to protect their investments in periods of low prices (as for example experienced during the pandemic). But fairness also implies that market participants that reasonably could protect themselves against adverse price-shocks but choose not to are generally not bailed out by society. The wholesale electricity market design, as well as the retail markets and network regulation, should not unduly favour certain participants in the system over others. Fairness also applies between European countries, as the market design should not unjustifiably give advantages to specific EU countries or regions.

3.2 Optimal investment

Electricity markets should incentivise optimal investments in the electricity system. Through appropriate investment signals, the most efficient technology choices should be installed at locations which provide maximum value to the system. Signals for investment in generation assets are required in addition to signals for the technologies required to complement renewables, such as flexible generation and additional network capacity. Given the urgency of the energy crisis and the climate crisis, efficient investment at speed is needed.

3.3 Optimal operation

Electricity markets should efficiently coordinate the operation of the electricity system, by minimising the cost of matching supply and demand in the short-run. With price signals that represent system conditions, market design can ensure the most efficient generation[11] is used to meet demand through the merit-order model, while encouraging demand-side response and optimising flows of electricity both within countries and between interconnected national systems.

4 Power system transformation

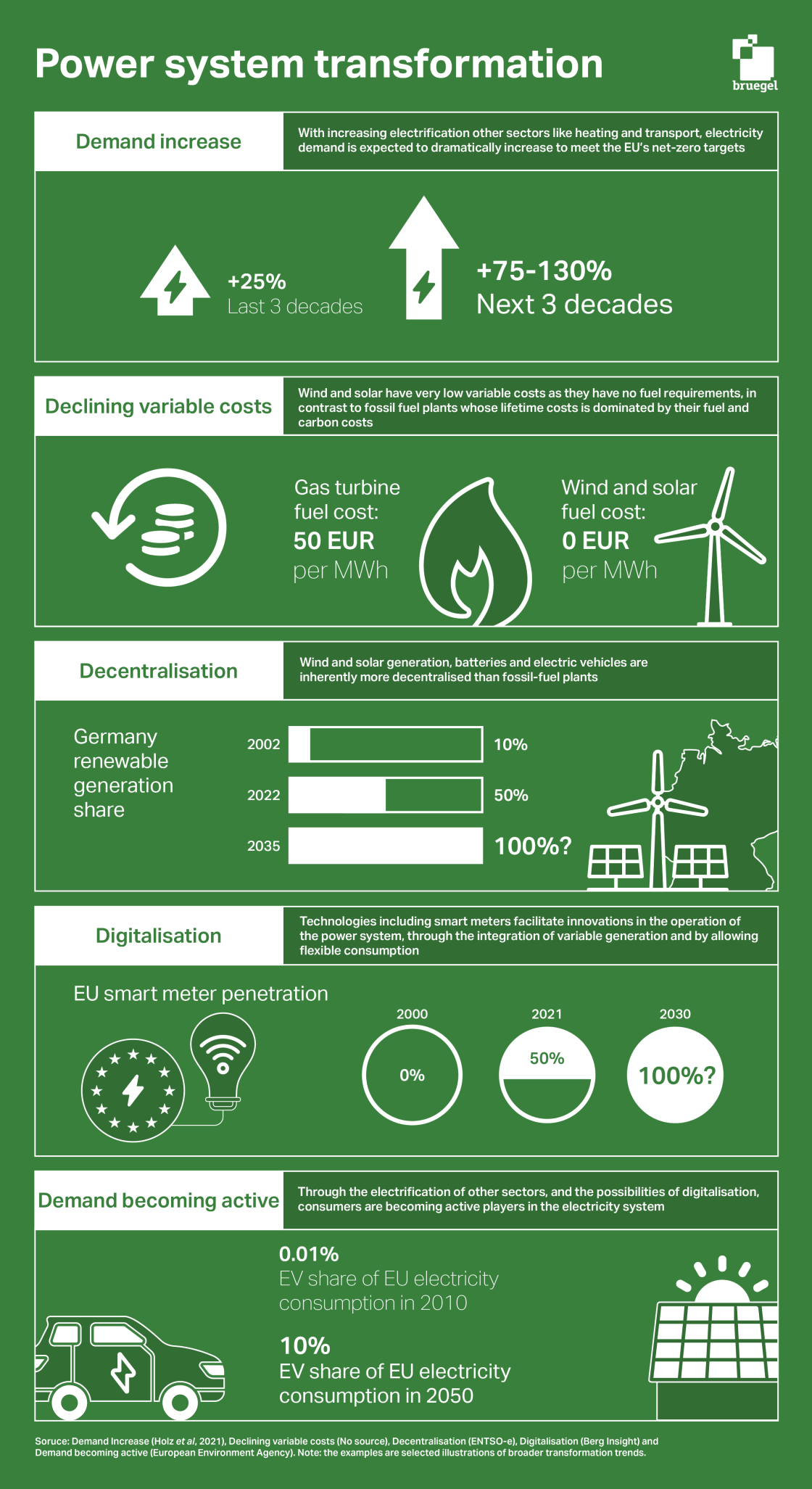

Even as electricity market reform is underway, the underlying electricity system is transforming fundamentally. The system is being restructured by the deployment of clean-energy technologies, the infrastructure required to support them and the potential innovations they unlock. A future-proof market design must take into account five structural shifts in the electricity system:

Figure 6: Five aspects of power system transformation

4.1 Demand increase

All energy system models foresee a dramatic increase in electricity demand to achieve the EU’s net-zero target. As substantial shares of heating, transport and industry demand must be electrified (4900–6500 TWh of electricity demand in 2050 compared to 2800 TWh in 2020, according to Holz et al, 2022), investment incentives in power generation need to be much more pronounced in the next three decades, when electricity demand will increase by 75 percent to 130 percent, than in the past three decades when electricity consumption only increased by about 25 percent[12].

4.2 Declining variable costs

While the upfront capital cost of building a fossil-fuel power plant is substantial, the bulk of the lifetime cost is operational expenditure driven by fuel costs. In other words, the short-run marginal cost of fossil-fuel plants is significant. With renewable electricity generation, the asset cost structure is inverted. Wind and solar farms have no fuel costs and therefore close to zero marginal cost. Consequently, their lifetime cost is dominated by the initial capital expenditure required to install the technology[13]. Different asset cost structures have different financing requirements, meaning that fossil-fuel plant remuneration mechanisms may not be suitable for investment in renewables.

4.3 Decentralisation

The electricity system developed over the twentieth century was quite centralised in its physical structure. A relatively small number of large power plants generated the electricity, which was then sent sometimes over significant distances along high voltage transmission lines, converted to lower voltage at transformer substations, and delivered to consumers through distribution lines. This legacy system is becoming increasingly challenged with the introduction of decentralised clean-energy technologies. At the transmission-system level, wind and solar generation and storage assets are inherently more geographically dispersed than fossil-fuel plants. At the distribution-system level, distributed energy resources, including solar photovoltaics, batteries and electric vehicles, mean that households and businesses can play an active role, even injecting their own electricity back into the grid. From a network standpoint, electricity can now flow both from generators to consumers, and also from prosumers back to the grid. Nodes in the electricity system that once only consumed electricity can now produce it too. Decentralisation will likely increase as more and more modular clean-energy technologies are added to the system (Zachmann and Tagliapietra, 2016).

4.4 Digitalisation

The broader economy is becoming more digitalised and the power sector is no different. Information and communications technology in the electricity system will create a multitude of opportunities for innovation. Much of the potential lies in integrating and optimising the use of decentralised assets, including wind and solar generation and batteries, or demand-side response. For example, commercially available technology can combine decentralised units into a so-called virtual power plant, which can trade the integrated value of the bundled resources on electricity markets. Other potential benefits from digitalisation arise from more accurate and more granular data about the system. Smart meters can provide households with the information they need to optimise their electricity consumption and to respond to system conditions, while non-wired alternatives[14] to grid investment could be supported by the digitalisation of the system – a development that would however need substantial regulatory change in Europe.

4.5 Demand becoming active

With the opportunities of digitalisation, along with the electrification of the heat and transport sectors, the demand side will become an active player in the electricity system. Consumers will be more flexible and responsive to system conditions, and will have the opportunity to co-optimise electricity, heat and transport (‘sector coupling’). Power-to-gas[15] also offers the potential for co-optimisation. Consumers are also increasingly becoming prosumers, utilising their own assets to produce power and sell the surplus back to the grid. Even more revolutionary possibilities are being realised, through the development of energy communities, which operate their own shared energy assets, storing and consuming electricity locally.

The system transformations that are taking place, and will no doubt accelerate as the energy transition proceeds, have deep implications for electricity market design. A targeted, medium-term reform that is focused on the objective of fairness by decoupling the costs faced by consumers from spot market prices could be insufficient. A long-term reform, that fully takes into account the consequences of a decarbonised power system and seeks to maximise its potential, is also necessary.

5 System transformation objectives

5.1 Does the current market design meet the objectives?

The current market design, defined by short-term marginal prices, cross-border integration and widespread state support schemes for renewables, has fulfilled the objectives defined in section 3 (fairness, efficient investment and efficient operation) to varying degrees.

Fairness in the current market design

On fairness, before the gas crisis, electricity prices were stable and affordable in many European countries. There was even a fear of too-low returns for generation companies in the electricity markets. The so-called ‘missing money’ problem in electricity markets meant the backup generation needed to ensure security of supply could not cover its costs through the short-term marginal pricing and thus other mechanisms, such as capacity markets or administered scarcity pricing, were needed (Newbery, 2016; Hogan 2017). There was also concern that introducing renewables would drive down the spot market price when they were producing, leading renewables to struggle to recover their investment costs – so-called “price cannibalisation” (Jones and Rothenberg, 2019; Halttunen et al, 2020).

With the gas crisis, electricity wholesale prices have reached record levels (exceeding €700/MWh on the German spot market), leading the resulting cost of energy to become unaffordable for vulnerable consumers. Meanwhile, the profits of many energy companies have increased. At the time of writing, electricity prices had returned to pre-Ukraine war levels (€100-€150/MWh), but remain high compared to before the pandemic (less than €50/MWh).

Emergency support measures for consumers have been introduced, but overall, high electricity prices have increased the cost of living for households and energy costs for businesses. Since energy companies have profited in the process (extraordinary profits have been reported by the oil and gas majors, above $200 billion in 2022, but profit increases have been posted by most European utilities too), there is an understandable perception that electricity markets have delivered unfair outcomes in the wake of the gas price shock.

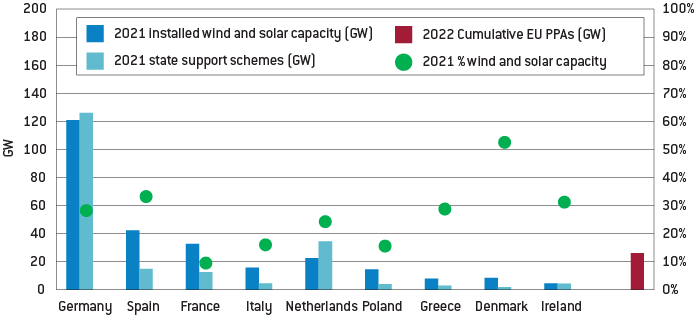

Investment efficiency under the current market design

The current market design has struggled to provide the right investment signals for renewable technologies. Before the energy crisis, spot market revenues were seen as too uncertain and too low to cover the cost of capital for renewable projects. Figure 7 shows the available data on the volumes of wind and solar capacity supported by the state on long-term contracts across several European countries, as well as the cumulative EU PPA contracted capacity. The renewable capacity receiving state support is likely underreported in the data because many such programmes began over a decade ago. Nevertheless, it is clear that long-term price certainty has been vital in making an investment case for renewables. State support schemes have been widespread in the financing of renewables. The low amount of capacity signed on PPAs relative to support schemes is also notable.

Pre-crisis, to ensure financial viability, these support schemes typically provided a top up to the spot market revenues realised by renewables, either via CfDs, feed-in premiums[16] or feed-in tariffs[17]. The level of support is typically determined via competitive auctions. Post-crisis, support schemes based on a fixed price are in many cases below spot market prices, meaning generators receive less revenue per MWh produced than they would at the market. In the context of the energy crisis, the anticipated benefit of such support schemes is that CfDs, backed by the state, will now provide a guaranteed fixed income to renewable projects, thereby reducing the cost of capital, while reducing consumer costs by having a price below projected spot market prices.

Figure 7: Installed wind and solar capacity and long-term contracted capacity

Source: Bruegel based on ENTSO–E Transparency Platform, AURES II database, resource-platform.eu.

Wholesale electricity prices by themselves were insufficient to incentivise the investment in flexible technologies, such as gas-fired power plants, needed to complement renewables. As a way to resolve the so-called ‘missing money’ problem, many countries have resorted to capacity mechanisms (or strategic reserves) to ensure the conventional generation required for reliability is kept online or newly installed.

Locational signals are inadequate in the current market design, meaning the value to the system of building generation at a specific site is not properly reflected by market prices. While building a wind farm at a windy site will generate more power, the system incurs additional costs if generation assets are installed in places in the network that cannot facilitate increased power flows[18]. In such circumstances, these assets cannot be used to their full potential and additional resources must be utilised elsewhere in the network, increasing the overall system cost.

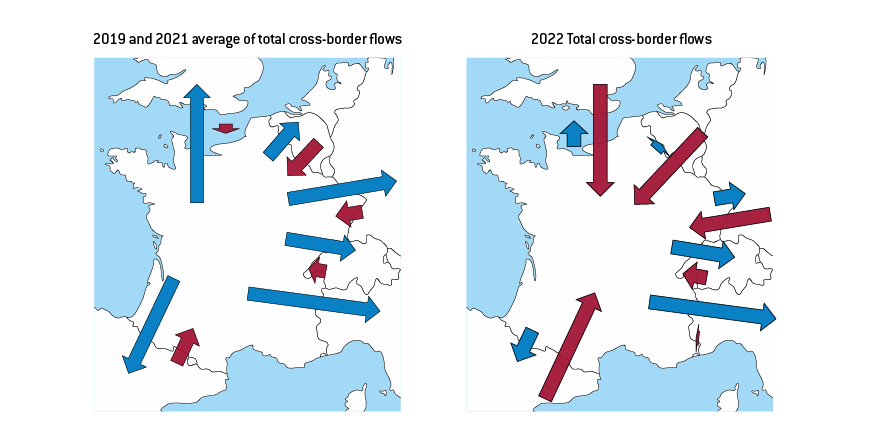

Operational efficiency under the current market design

Regarding the optimal operation objective, the current market design sends adequate signals for the efficient matching of supply and demand in the short run. The merit-order model minimises the cost of using the available supply to meet a given level of demand. The marginal price signals that emerge from the merit order also send signals for flexibility (storage, demand-side response, etc), and, crucially, cross-border exchanges of power. The latter was vital in allocating scarce electricity supply across Europe during the crisis in 2022. France, historically a net electricity exporter, imported a significant share of its electricity from neighbouring countries (Figure 8). These exchanges were primarily coordinated through electricity markets via the marginal price signals, avoiding the need for difficult political negotiations.

Figure 8: France’s switch from exporter to importer of power

Source: Bruegel based on ENTSO-E Transparency Platform. Note: The length of each arrow is proportional to the total import and export of electricity.

One aspect of operation in which the current design does not achieve strong outcomes is demand response. Industrial consumers that can provide balancing services to system operators by flexibly reducing their demand during periods of scarcity have not been well-integrated into the electricity markets. Furthermore, dynamic pricing, in which some or all of the hourly wholesale price is passed through to consumers, is available only in Spain at present. While the energy crisis has demonstrated that such pricing has risks in terms of exposing consumers to volatility, increasing the responsiveness of households and small businesses to electricity system conditions will likely involve some level of exposure to system conditions.

Overall, at present, the market design sends adequate signals for the operation of the system. It provided a fair distribution of costs and benefits pre-crisis, but has suffered in the wake of the price shock, and has generally struggled to provide sufficient market-based signals for optimal investments.

5.2 Objectives in the transition to a decarbonised power system

Updating the market design to better meet the objectives based on a static view of the system will end in failure. It will not provide incentives aligned with the deep transformations that are taking place (section 4). Achieving a sustainably successful market design during the energy transition will require careful consideration of how the system transformations impact the core objectives of electricity markets. The following subsections discuss the challenges shaped by the system changes and the detailed aims for the market design.

Fairness during the transition

The gas price shock along with low nuclear and hydropower availability caused unprecedented volatility in European electricity markets in 2022. Given the many challenges ahead, further volatility can reasonably be expected during the transition. Price volatility could arise from further international commodity price shocks, or from more typical factors such as reduced availability of existing generation, for example because of another extended drought or from drastically increasing electricity demand (for example in an extended cold snap). Increasing the share of renewables in the generation mix may lead to greater price volatility, although the evidence is mixed and depends on the time-horizon considered (Pototschnig et al, 2022; Cevik and Ninomiya, 2022). Electricity market design should help consumers, especially households and small business, to safeguard their overall energy-cost level against price spikes, either through supplier hedging or other means.

Another fairness consideration relates to the potential of decentralisation and digitalisation to provide consumers with technologies to optimise and monetise system-friendly patterns of electricity use. Investing in a combination of solar photovoltaics, for example, could potentially reduce the need at times to take electricity from the grid, and could even provide a cashflow through the sale of surplus power back to the system. However, while these consumers will continue to benefit from the services provided by the electricity network when they cannot produce their own power, under the current network regulations they would pay a smaller proportion of its costs because they are purchasing less power from the grid. The same issues could occur with energy-efficiency investments. Higher-income consumers will benefit from such efficiencies first, meaning that the burden of paying the fixed network costs will begin to increasingly fall on lower-income consumers (Claeys et al, 2018).

Market design, especially the retail markets and the broader network regulation, can be a vehicle to recover the costs in a fair way and distribute the benefits of a decarbonised power system. However, the case above shows that technological changes may change the current balance in the coming years. For example, by changing network regulation so that consumers pay a portion of the network costs as a fixed fee rather than a volume-based tariff, or by adjusting retail market design to facilitate local electricity trading between prosumers, system costs can be recovered in a balanced way throughout the transition.

Investment efficiency during the transition

Rapid deployment of renewables is essential to reduce Europe’s strategic dependency on fossil fuels and to decarbonise the power system. Electricity markets should send strong signals for private investment in renewables, as the state should not underwrite all capacity in the system. EU annual generation investments alone would amount to 1 percent of GDP for a net-zero compatible power system (Holz et al, 2021). Furthermore, the investment risks should be allocated appropriately between private entities, the state and consumers. Clear market-based signals are required to attract private investment.

More broadly, electricity market design should consider the whole system cost. Renewables have recently become the cheapest source of generation, but because of their variability, the system requires additional investments to provide the services demanded by consumers. Poor location of generation can increase grid costs, for example. Renewables in the wrong places in the network can also raise system costs by limiting their maximum output and increasing the need for additional reserve capacity elsewhere in the system. Including locational and flexibility signals in the market design would create incentives for more efficient investments, reducing the overall cost.

Locational marginal pricing or nodal pricing – a wholesale market design which takes into account grid congestion by determining a marginal price at each node in the transmission system – has long been discussed as a possible alternative to the current design that would account properly for the locational aspects of the electricity system. The market design is currently applied in the liberalised power markets in the United States. Many of the objections to implementing this approach in Europe, including that market power could be exerted under this design since the relevant market areas are small, or that nodal pricing would create barriers to flexibility, have been shown to be invalid (Eicke and Schittekatte, 2022). A key issue with nodal pricing is that it would create differentiated prices for consumers within countries, an arrangement that would face serious political opposition. However, there are other approaches to improving the locational signals in electricity markets, for example through creating smaller bidding zones or through variable network tariffs.

RTE (2021) estimated the annualised full costs for the French electricity system in 2060 across a number of scenarios, finding a difference of €18 billion per year between the least-expensive and most-expensive scenarios. Given that France supplied approximately 19 percent of total electricity generation in the EU in 2021, it is plausible to assume that efficient investments in the electricity system in the coming decades could save the EU up to €100 billion per year by mid-century.

Operation efficiency during the transition

The electricity market can be considered as a coordinating system for several types of flows that occur in networks with natural monopoly characteristics (physical wires, data-exchange platforms and financial-flows), within the electricity system and with other energy systems (heat, transport, energy-storage). The electricity system will become more integrated with other energy systems as heat and transport are electrified, and therefore the market will need to efficiently coordinate the matching of greater and more diverse supply and demand in the future.

The emerging challenge is for the market to send strong signals on flexibility (through demand response, storage and low-carbon reserve generation) and maintain the current effective management of the system, especially in cross-border trade. The marginal prices that emerge from the merit-order model in wholesale markets can achieve this objective, provided demand can respond to those prices while continuing to be insured against severe volatility. The market signals for efficient operation can be improved by increasing granularity in both time (eg short market time periods and longer forward market horizons) and space (eg smaller bidding zones or even locational marginal pricing) (Newbery, 2018).

6 Implications of reform proposals

To meet electricity market design objectives in a rapidly evolving power system, reforms are necessary. Long-term contracts have been proposed as a way to provide consumers with lower and less-volatile prices, while giving renewables the guaranteed income required to reduce the cost of capital. In many of the positions taken by EU countries (annex 2), the formal recognition of capacity markets is proposed as a way to support flexible backup generation. Such approaches have deep implications for the long-term configuration of European electricity markets, depending on the choice of instrument. In the past, the liberalisation of Europe’s electricity markets aspired to ensure coordination of operation and of investments across participants and countries through the use of a European market. This vision never materialised because EU countries did not trust that market signals would deliver the desired investments. The current reform proposals could, perhaps inadvertently, formalise a departure from this vision.

Four of the proposed long-term contracting instruments are CfDs, PPAs, capacity mechanisms and forward markets:

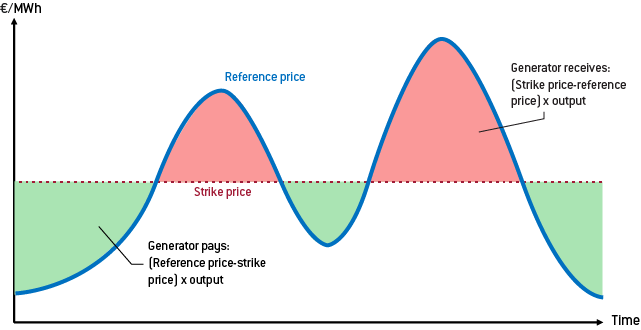

6.1 Contracts for difference (CfDs)

Figure 9: Contracts for difference

Source: Bruegel.

Contracts for difference (CfDs) are a type of financial contract that are commonly awarded through state-supported auctions for renewable electricity. CfDs involve a strike price and a reference price (usually the spot price). In periods in which the reference price is lower than the strike price, CfD holders receive the difference between the two prices, multiplied by their generation output, from the counterparty (the state). In periods in which the reference is higher than the strike price, CfD holders must pay the difference between the two prices, multiplied by their generation output, back to the counterparty. The outcome is that the holder of a CfD receives a fixed price (the strike price) for the electricity they produce.

The CfD strike price is determined by competitive auctions, in which a national government tenders for a target energy demand over a certain time period, usually 15-20 years. Renewable projects compete by making bids for the required level of support. The lowest bids which meet the demand are awarded a CfD. Typically, the level of support (the strike price) is uniform and is set by the highest value bidder needed to meet the demand, otherwise known as pay-as-clear. The costs of paying the CfDs are recovered via levies on consumer bills.

Some EU countries (France, Spain and Portugal) want more widespread use of CfDs as a means to both support renewables and reduce consumer prices. There are a few options for their application. CfDs could be optional for new projects, or it could be mandatory for new projects to participate in CfD auctions, or CfDs could even be forced on existing projects. The Commission’s March 2023 proposal sets CfDs as the default instrument for European countries to support non-fossil fuel electricity generation (European Commission, 2023).

| Benefits | Risks |

| CfDs provide a guaranteed income to renewable projects which have high capital costs, thereby reducing price risk and the associated cost of capital. | CfDs can create operational distortions as generators are guaranteed a fixed price for their output, regardless of the system conditions at the time. For example, a generator may schedule maintenance during the winter, when demand is higher but materials are cheaper. |

| CfDs can hedge consumers against price volatility by ensuring that a proportion of generation is signed to long-term fixed price contracts. During periods in which spot market prices are higher than the strike price, consumers receive the difference. | Given the inflationary energy and macroeconomic environment, there is a risk that CfDs will lock in inefficiently high prices. Furthermore, given that spot market prices are projected to remain high for several years, there is a possibility that there will be reduced participation in auction schemes as developers prefer to earn their revenues through the markets. Low participation in auctions will reduce competitive pressure and therefore also increase prices. |

| By providing attractive financing conditions for renewable projects, CfDs can incentivise the installation of large quantities of renewable capacity. | States act as the counterparty in CfD contracts with the costs paid directly by consumers. As there is a risk that CfD strike prices will be inflated for several years, consumers may ultimately bear the price risk. Even more importantly, huge investment is required in the system, and guaranteeing the remuneration of nearly all new renewable would have a sizeable fiscal impact. |

The literature discusses several ideas to overcome some of the shortcomings of CfDs. For example, the payment for CfDs could be linked to a reference renewable generator’s output, rather than the actual output of the CfD holder. With this contract design, renewable plants would have an incentive to still produce in hours when prices are high. Varieties of this proposal have been described as a “financial CfD” (Schlecht, 2022) or a “yardstick CfD” (Newbery, 2021). The design of the CfDs will matter significantly for efficiency and fairness.

As CfDs will most likely be designed and underwritten by EU countries[19], national governments will indirectly determine how much of which technology will be de-risked, and where and when. There is no guarantee that governments will determine an efficient outcome, let alone one that complements the deployments made by other countries.

6.2 Power purchase agreements (PPAs)

PPAs are bilateral contracts between electricity generators and consumers. They are usually long-term contracts of 10 to 15 years, and can be adjusted to meet the preferences of the parties. They can be linked to the physical delivery of electricity (in which the power producer has the obligation to produce a certain profile of electricity over the contract period), or based only on financial obligations (effectively a CfD between the contractual parties). The generators that sign PPAs are often renewable projects seeking price certainty, while the consumers are typically large energy users such as data centres or manufacturers in the metal industries[20]. In the Commission’s March 2023 proposal, PPAs are included as an important tool for producers and consumers to enter into long-term contracts. However, the proposal includes provisions to allow EU countries to act as guarantors of these contracts, with the aim of reducing risk for private parties and encouraging increased PPA trading (European Commission, 2023).

| Benefits | Risks |

| Parties that enter into PPAs can hedge their production or consumption. PPAs allow parties to allocate price and volume risk according to their preferences in the contractual terms. | The PPA market has struggled to match supply and demand, as generators typically seek long-term price certainty, while only large companies (eg tech firms) can offer the necessary credit guarantees to cover the risk of payment default. |

| PPAs can be used by large energy consumers to reduce their corporate emissions from purchased energy by entering contracts with renewable producers. | The development of renewable projects financed by PPAs may not provide the optimal value to the wider electricity system, as they serve the needs of just one large consumer. Therefore, PPAs may crowd out more beneficial generation investments. |

PPAs have provided only a fraction of the remuneration for renewable projects in European markets. Encouraging the uptake of PPAs would, in contrast to CfDs, lead to private entities taking on greater risk. The Commission’s proposal to allow European governments to take on some of this risk could reduce some barriers to the take up of PPAs, but as these contracts are typically opaque, governments should act cautiously and provide guarantees only under conditions of transparency. But non-standardised contracts between often smaller players might result in relatively rigid constructs that might fail to adjust smoothly to changing circumstances over the lifetime of the contract (eg an up-taker might have less incentive to reduce its consumption as it cannot resell the contract volumes). Moreover, transaction costs for idiosyncratic contracts within a country are lower than if buyer and seller are from different countries, potentially encouraging cross-border fragmentation.

Providing standardised contract formats and facilitating the pooling of supply (integrating renewable projects) and demand (combining the energy needs of multiple smaller consumers) may boost the uptake of PPAs. However, such improvements would bring PPAs closer in design to existing forward markets. Therefore, developing forward markets to meet the requirements of parties currently operating in the PPA market could be a more effective approach.

PPAs are in general in line with the vision of a market-based development of the system. However, a strong focus and potentially national public support for them will tend to lead to more fragmentation.

6.3 Capacity markets

Capacity markets (or capacity mechanisms) are support measures that provide ‘capacity payments’ to power plants for being available to generate electricity to meet peak demand when needed, especially during exceptional periods such as when many generators are on outage or there is low wind and solar availability. State aid approval[21] is required to implement a capacity market as they are considered state subsidies for specific technologies, and only some European countries have them in operation[22].

Capacity payments are awarded via competitive auctions, typically a few years before payment (and corresponding availability of capacity). Payments are made on a per kilowatt basis, remunerating generators for availability rather than for generation. The conditions for receiving payment differ across EU countries, but are targeted towards giving generators an incentive to be available to deliver power during periods of scarcity.

| Benefits | Risks |

| Ensure security of supply by supporting the power plants that are needed to meet peak demand during periods of scarcity, but which cannot recover their costs from other electricity markets. | Can be used to support unviable and carbon-intensive technologies on the basis that they are required for security of supply. |

| Support flexible technologies, like interconnectors and storage, needed to complement a system based on large shares of renewable electricity generation. | Depending on their design capacity mechanisms, they can have distortive interactions with other markets that can lead to bad operational incentives. |

To utilise capacity markets effectively, a number of conditions for their implementation should be established. Support for carbon-intensive plants that are unnecessary to meet security of supply should be phased out as soon as possible. State-aid approval should continue to be required to guard against anti-competitive application of these policy measures. Capacity mechanisms should instead be targeted toward clean dispatchable generation and flexible technologies.

Continuous refinement of the conditions for receiving capacity payments should be undertaken to avoid operational distortions with other electricity market elements. As more clean and flexible technologies make use of capacity payments, the importance of beneficial operational signals will continue to arise. Capacity markets should aim to incentivise availability of flexible technologies when most needed, without distorting the functioning of spot and forward markets.

Capacity mechanisms will likely continue to be national even though they could also be European. Introducing complex interfaces between national capacity mechanisms might encourage more European coordination of corresponding investments. But they are still an instrument that will rely strongly on national planning.

6.4 Forward markets

Electricity forward markets allow participants to trade forward contracts[23] and future contracts[24] months and years ahead of the delivery of energy, although the contracts usually last no longer than four years. Prices are determined by bidding zones, which effectively overlap with national borders. Both baseload contracts and peakload contracts are available to trade as futures, linked to the average price in different hours. The volumes traded on forward markets far exceed those traded on the spot markets.

| Benefits | Risks |

| Forward markets allow market participants to hedge their position in the markets, thereby reducing price risk. | The products available on forward markets are typically no longer than four years, which is too short for many generators to satisfactorily hedge their positions, especially renewables that require more price certainty. |

| Forward markets could cause macroeconomic instability during extreme price shocks. The details of forward contracts are opaque and could be based on risky terms, while clearing houses require huge margin calls when prices become volatile. |

Forward markets could be developed through the introduction of standardised long-term contracts that meet the needs of buyers and sellers seeking to hedge their positions over timeframes longer than three to four years. Liquidity in forward markets could also be improved, for example through national governments periodically reselling their CfDs as futures. This would also allow states to manage the price risk associated with the CfDs. Liquidity could be further improved by facilitating increased cross-border trading in forward markets, as discussed in a report by the Agency for Cooperation of Energy Regulators (ACER, 2023). The Commission proposed establishing regional trading hubs that would provide a reference price for forward contracts as a means to achieve such improvements in liquidity.

In contrast to the three other instruments, forward markets would leave coordination to European markets (not planning by member states).

6.5 Interplay

The interplay between national system development, European planning and European markets is ill-defined. At best, a liquid European forward and spot market would partially correct inefficient and uncoordinated national incentives. At worst, volatile national incentives will lead to overbuilding of parts of the system, while fragmenting markets and creating uncertainty that dries out efficient markets.

National incentives based on national planning fail to take a European system perspective. At present, there is no official position on European system planning, even though the benefits of a continentally integrated electricity system were demonstrated throughout the energy crisis in 2022, and have brought billions in savings for consumers in previous years (ACER, 2022). Given that many of the reform proposals, such as the formal recognition of capacity markets as a necessary instrument and the promotion of national CfD auctions, point towards a stronger role for governments in the development of their national energy systems, formal European-level system planning and forecasting would be needed to, at least, assist national decision-makers in understanding how their choices fit into a European system. A nationally dominated approach may fail to capture the potential that such a European perspective could provide in improving the overall efficiency of electricity system development, ultimately increasing energy costs for European consumers.

The conceptual question is therefore: how will investment decisions be coordinated in order to get to an efficient and resilient power system in Europe? An inconsistent patchwork of partial markets and uncoordinated national and European interventions risks making the transition significantly more expensive, and thus likely delaying it.

7 Our proposal: phased reforms

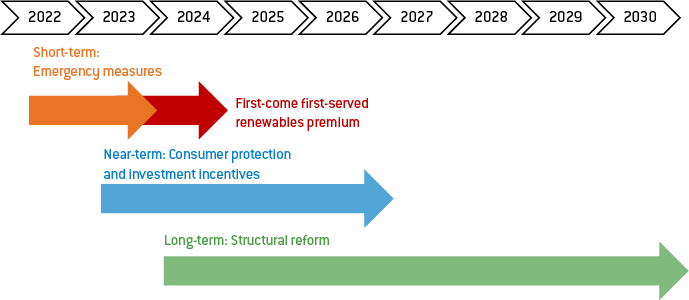

It will not be possible to come up with a comprehensive market design reform that resolves emergency, near-term and longer-term issues quickly. We thus propose to split market design reform into three stages: (1) Emergency measures, such as demand-reduction measures and a wholesale market revenue cap, have already been approved and their implementation is ongoing (Council Regulation (EU) 2022/1854). Some of the measures might already expire in 2023. (2) The upcoming near-term reform – based on the European Council conclusions of 15 December 2022[25] and the European Commission’s March 2023 proposal – should aim to introduce measures that ensure that much-needed renewables and flexible resources are deployed rapidly, while enabling consumers to better insure against price shocks. (3) To continue to align the electricity markets with the deep transformations of the electricity system throughout the energy transition, a long-term structural reform process should be initiated later in 2023. This structural reform must take the time needed to fully consider the implications of a decarbonised power system for the design of the market framework.

Figure 10: Phased electricity market reforms

Source: Bruegel.

7.1 Emergency measure to meet the REPowerEU target and bridge uncertainties

Discussions on market design could create uncertainty about the future cashflows of renewables plants. This could discourage investments that are needed urgently to move out of the current energy-supply crisis and meet the 45 percent renewables by 2030 target of REPowerEU, the EU’s plan to accelerate the energy transition and reduce dependence on Russian fossil fuels.

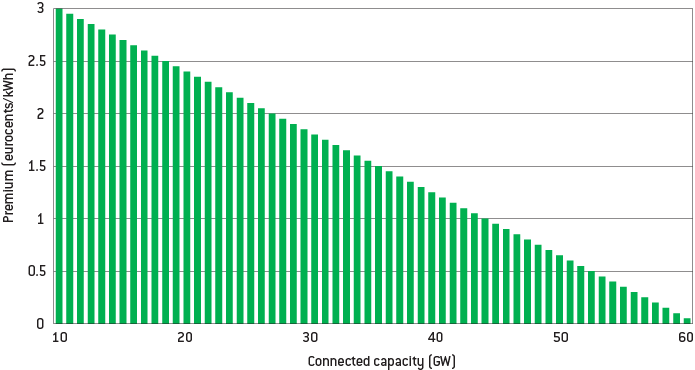

To boost investment in renewables while a more structural market reform takes place, the EU could provide a first-come, first-served European feed-in premium for new generation connected in 2023 and 2024. The premium would be additional to other cashflows and subsidies, and would be paid in €/kWh over the first five years of operation. For the first connected gigawatt of wind-power, €3/kWh would be paid, reducing by €0.05/kWh for each additional gigawatt and reaching zero after 60 GW of capacity had received some bonus[26]. Doing the same also for solar would provide support to 120 gigawatts of installed capacity. Together, those would produce about 240 TWh per year (EU total generation in 2021 was 2,785 TWh).

The subsidy would be paid only once a plant has connected to the grid, to ensure that supported capacity delivers energy. This structure would provide strong economic incentives for accelerated deployment. Splitting the subsidy payment between the investor in the plant and the network operator would create incentives also for grid operators to speed up grid connections[27].

This European extra feed-in-premium would cost around €3.5 billion per year. If 10 percent of the deployed capacity comes online one year earlier than otherwise, it could save €25 billion in this first year of operation. That assumes that an extra 1 GW of wind power reduces the power price by at least €5/MWh. To ensure each EU country receives a certain volume of support, 70 percent of supported capacity could be allocated to member states according to share of EU population. The remaining 30 percent could be allocated to the quickest-deployed project, regardless of location. Funds could be raised via the Innovation Fund, possibly with matched contributions from member states.

Figure 11: First-come, first-served renewables premium

Source: Bruegel.

7.2 Near-term measures to safeguard consumer bills

The main political motivation for kicking-off the process of reform of the current market design was the current design’s failure to distribute the costs and benefits of the system fairly in the context of a price shock. The emergency revenue cap approved in 2022 will most likely not generate the revenues needed to compensate consumers sufficiently for rising electricity prices. At the same time, particularly aggressive implementations of the measure by member states might undermine the confidence of investors – such a loss would translate into increasing capital cost for the significant future electricity generation investment needs – and hence imply substantially higher electricity generation costs in the future. A main challenge is that in the complex contractual arrangements, the ultimate beneficiary of high wholesale prices at a certain point in time cannot be identified easily. The producer might have long sold the power to a trader, or the consumer might have hedged against high prices via its retail contract or financial hedges. Structural revenue caps might discourage beneficial self-insuring behaviour. This is of relevance, as the extension of revenue caps beyond 30 June 2023 is considered as one of the possible near-term measures.

We propose the development a set of rules on the use of revenue caps. Excessive wealth transfers from consumers to producers should be avoided during energy supply shocks, but incentives for investment should also be maintained by reducing investor uncertainty. Revenue caps should include clearly defined trigger conditions, which would be only activated when price shocks pose risks of substantial macroeconomic consequences. Ideally, officials would have access to better data to allow them to recover excessive profits from the ultimate beneficiaries.

As well as such a European commitment device against ad-hoc revenue caps, distributional issues should be dealt with at member-state level through fiscal policy and retail market rules. The EU should therefore provide guidelines to ensure that national retail market regulations and sectoral taxation policies that aim to address distributional concerns do not imply substantial distortions[28] of the internal market.

7.3 Near-term investment incentives

Overcoming supply shortages through investment is the most structural solution to reduce electricity prices and benefit consumers. And investing significantly more in renewables will be a no-regret choice in essentially all net-zero compatible scenarios, and will also benefit consumers in the long run (Cevik, 2022).

More long-term contracting is desirable to encourage investment and enable consumers to hedge their future energy bills against rising prices. Long-term contracts spread between the parties the volume risk (how much electricity is needed, where and when) and the price risk, but also other risks including the counterparty risk, the construction risk, operation risk, macroeconomic risks (inflation, interest rate) and policy risks. For economic efficiency, each party should bear the risk it can best control: eg the construction risk should be borne by the seller. A complex network of contracts[29] between plant owners, utilities, investment funds, banks, energy traders, retailers and consumers serves to allocate these risks. But the substantial risk of policy decisions for the future cashflows of new installations cannot be properly hedged by private parties. This means some public de-risking can be welfare improving.

A reform on the European level should therefore focus on making market-based risk allocation better and enabling governments to absorb the risks they can best control. This calls for liquid hedging products that match the needs of market participants. For example, there might be more need for contracts that hedge buyers against extreme prices in hours where the renewables they secured (eg via PPAs) are not producing. As electricity is a product that is strongly differentiated by where and when it is being delivered, specific markets might be relatively small. Having very liquid benchmark products complemented by narrower-spread products could allow cost-efficient hedging. Methodical monitoring of the markets for irregularities – especially the exercise of market power – would also increase trust. Ideas to support the market for bilateral contracts (PPAs) by providing public guarantees to reduce financing costs require careful design to prevent states taking unidentified risks, providing massive implicit state aid or, most importantly, undermining the internal market by only supporting domestic transactions.

The design of capacity mechanisms will be important. They should incentivise the most efficient solutions[30], including by allowing participation of resources in neighbouring countries, demand-side resources and resources that are particularly clean and flexible. European oversight capacity mechanisms are required to prevent unnecessary fragmentation. Also required are rigorous ex-ante and continuous ex-post evaluation of the instrument’s performance, to ensure it makes a positive contribution.

In all likelihood, European decision-makers will give state-backed CfDs a stronger role in moderating the cashflows of generation assets[31]. Again, design will matter. A key risk is that important signals on efficient volumes, location, technology and production-pattern of investments are lost because of overly simplistic design. In an extreme case, ill-designed CfDs can lead to a monoculture of the one production technology with the lowest levelised cost of electricity, all located in the same favourable area, but the power those plants are remunerated for is actually worthless. One major improvement for CfDs would be to delink the pay-out from the actual generation of the asset, and instead make it a purely financial instrument linked to the output of a ‘yardstick’ renewable plant (Newbery, 2021; Schlecht, 2022).

Mandatory CfDs are also being discussed as a tool to enable governments to receive some of the excessive revenues made by existing and/or new generation assets of certain types. This is likely not a very efficient redistributive tool. It would disincentivise marginal plants that, because of their higher cost were just about profitable, while plants that earn significant rents because, for example, they were given access to very favourable grid connections or land, still earn substantial profits. Fiscal tools might be better, such as taxing the value gained from land zoned for renewables, and mitigating excessive profits by improving investor access, for example by simplifying procedures and fair network access, also for non-incumbents.

The stated benefit of long-term contracts, whether CfDs, PPAs or others, is that these contracts are expected to be priced below spot market prices, thereby reducing costs for consumers. On the generation side, the assumed benefit is that the guarantee of a fixed, stable income will reduce the cost of capital for renewables projects. The hope is that lowering capital costs and lowering the profits of power generators can be used to relieve pressure on consumers.

Box 1: Near-term reform: main risks

Policymakers should take into account a number of risks present in reform proposals.

Long-term contracts signed in the near-term could lock-in high prices, with developers likely adding a premium to their bids given the current inflationary macroeconomic environment and record-high electricity price levels (a capacity market auction in the United Kingdom cleared at record levels in February 2023[32]). Prices that look like a reduction in 2023 could ultimately be costlier than spot market prices within a few years. And support mechanisms that continue to affect the dispatch of the supported units in a future system[33] need to be designed to encourage efficient operation in a system that looks very different from today’s.

Even with increasing investments, there is a risk that inefficient projects are financed, for example by focusing overly on generation instead of grid expansion, thereby significantly increasing the total system cost.

Moreover, technology choices and the applied support mechanism will have distributional consequences: for example, relieving household and community solar PV from the cost of networks and back-up capacity might disfavour the most vulnerable households, which might end up paying a higher share of these costs.

Since many of the reform proposals imply greater public financing of the electricity system, there is a risk that different levels of state fiscal capacity will lead to distributional imbalances in investment across Europe. This could cause a fragmentation of the internal electricity market as European countries compete to provide more support to renewable generation in order to drive down electricity prices, potentially seeking in the process to limit their interconnection capacity with other regions. The Commission’s March 2023 proposal contains short-term measures to create new investment instruments that may be adopted quickly, but the EU should take more time to decide on a consistent framework for common investment in the power system.

7.4 Long-term structural reform

In addition to the targeted, near-term reform underway, the European Commission should initiate an assessment of the implications of the electricity system transformations discussed in section 4 for electricity markets over a long-term horizon. Long-term structural reform is needed for two reasons: to properly assess the conceptual role of electricity markets during the energy transition and to optimise a fundamentally transformed system.

To ensure the future market design can enable an efficient transition, two major conceptual questions should be answered: What is the balance between the state and the markets in the electricity system? And what are the respective roles of national governments and EU institutions?

Optimising a system based primarily on renewables will require different market signals to those provided through the current design. Markets will need to maximise the potential of decentralisation and digitalisation, for example by incentivising energy communities and trading at the local level. The efficient operation of a much more flexible and dynamic system, in which the demand side plays an active role, will need to be planned for. The appropriate financing scheme for capital-intensive assets like renewables, and the infrastructure required to support them (such as sizable grid investments), also requires ample planning.

The fundamental system transformations underway might imply more revolutionary approaches, such as: (1) redefining the role of retail markets to ensure they provide real value for consumers; (2) relaxing some unbundling provisions at least for regional experimentation. This could allow testing of new ways to integrate network development, demand-side participation, decentralised generation and storage development; (3) guiding public and private stakeholders through a European public energy system planning exercise; (4) finding better tools to incentivise a more dynamic European network development, in line with European decarbonisation tools; (5) capturing and redistributing excessive rents from crucial assets such as land allocated to renewables; or (6) Europeanising electricity system operation to allow more efficient dispatch and investment signals.

These complex and interacting discussions will require proper analytical underpinning and enough time for a transparent exchange on the priorities and trade-offs. At present, there is a stark lack of analysis of reform proposals (Box 2). We propose a process similar to that which took place before electricity market liberalisation in Europe.

In January 1995, a green paper on an internal energy market was published by the European Commission, after a process that began in 1993 (European Commission, 1995). The green paper provided a basis for evaluating whether the European Economic Community should have a greater role to play in energy. A thorough assessment was done of the current energy situation and the challenges for Europe. The paper concluded that there was a need for greater cooperation, consistency across national and Community energy policy (especially regarding security of supply), and a response to the challenges of pollution and climate change. A white paper was then published in January 1996, setting out an energy policy framework at European level, making use of input gained during a policy debate on the content of the green paper (European Commission, 1996). The white paper considered the energy trends of the time and possible energy futures, and provided guidelines on implementing the internal energy market. Questions of external dependencies and sustainable development were also addressed. The first Electricity Directive (96/92/EC) setting common rules for the internal electricity market was then adopted in December 1996.

Following the timelines of the process described above, and adding a level of urgency given the simultaneous energy and climate crises, if a debate is initiated in 2023, a green paper on the European electricity market of the future could be published by the European Commission by the end of 2024. The green paper should consist of a deep analysis of possible futures for the European energy system, especially the electricity system, and the market designs that would best suit them. Following a policy debate on the contents of the green paper, the 2024-2029 Commission could publish a white paper in 2025, setting out a comprehensive vision for electricity market design, determining the right balance between state and market, and states and the EU, in the electricity system and the optimisation of a decarbonised power system.